Wentz Weekly Insights

Fed Tilts More Hawkish While Debt Ceiling Negotiations Continue After a Brief “Pause”

Week in Review:

Recent Economic Data

- Business activity in the New York region fell sharply in the first two weeks of May, according to the Empire State manufacturing survey. The report’s general conditions index level was -31.8, a drop of over 40 points from April for the sharpest sequential drop ever and the lowest level since January this year when it hit -32.9 and second lowest since the record lows in May 2020 from Covid shutdowns. New orders and shipments “plunged” after a very short period of rising, employment declined, while prices increased at the same pace as April. The percentage of respondents saying conditions improved was 17% while 49% said conditions have worsened. Capital spending plans were more sluggish as businesses continue to expect little improvement over the next six months.

- The Philly Fed manufacturing survey showed conditions continue to decline overall in the Philadelphia region. The index was -10.4, and improvement from the -31.3 that was the lowest since the Covid lows, but in negative territory since August 2022. General activity, new orders, and shipments all declined, but at a much lesser pace than in April, while employment fell and prices fell further. Firms continue have muted expectations for growth over the next six months.

- US industrial production, which covers manufacturing, mining, and electric/gas utilities, increased 0.5% which is better than the no change that was expected however it follows a downward revision from the prior two months so the net gain was in line with expectations. The April increase was driven by an unexpected 1.0% increase in manufacturing. The sector was helped by strong gains in output of vehicles and parts. Capacity utilization was 79.7%, a small drop from recent levels but still within the range of its long-term average.

- The National Association of Home Builders housing market index, which measures homebuilder sentiment, rose 5 points in May to 50 for the fifth consecutive monthly increase and the first time at/above 50 since July. A level of 50 is neutral and anything above 50 reflects positive sentiment from homebuilders. Home builder sentiment over the next six months improved to 57 from 50, while traffic improved slightly to 33 from 31 and up from very depressed levels of 20 in late 2022.

- The number of housing starts in April was at a seasonally adjusted annualized rate of 1.401 million, this is 2.2% above March’s rate but 22.3% below the rate from April 2022. Housing starts are down significantly from the post-Covid rebound and are still about 150k below pre-pandemic levels. The number of permits to build a new home fell 1.5% from March to a seasonally adjusted annualized rate of 1.416 million and is also down significantly from a year ago, down 21.1%. We would hope to see these numbers pick back up as there is still a substantial shortage of new homes on the market.

- Existing home sales fell 3.4% in April to a seasonally adjusted annualized rate of 4.28 million homes and is down 23% from a year ago. Aside from higher rates, sales continue to be affected by tight supply. There were just 1.040 million existing homes for sale on the market in April, up just 0.1% from last year and given the sales pace the inventory would last just 2.9 months, which compares to a balanced market of 6.0 months supply. The median home price was $388,000, down 1.7% from a year earlier. However, price trends are very different regionally – falling in the South and West but rising in the Midwest and Northeast. Also of note, sales are becoming weaker in the upper end of the market with sales of homes $500k and above falling at a higher pace.

- The number of unemployment claims filed the week ended May 13 was 242,000 which was a decline of 22k from the prior week. The four-week average was relatively unchanged at 244,250. Continuing claims fell 8k in the week to 1.799 million with the four-week average at 1.812 million. The drop, and low levels, of new claims continues to reflect a tight labor market and appears people that get laid off are able to find a new job relatively easily.

- Retail sales in April rose 0.4%, roughly half the increase that was expected, and are just 1.6% higher over the past 12 months for the slowest yearly increase since the Covid outbreak. The past three months of retail sales, which is used to filter out month-to-month noise, rose 3.1% from the same three-month period last year. These are weaker retail sales number, especially when you factor in inflation. Real retail sales, which adjust for inflation, are down 2.2%. Roughly half the major categories saw an increase in sales in April. The best were miscellaneous store retailers up 2.4%, online sales up 1.2%, general merchandise stores up 0.9%, health/personal care stores up 0.9%, and restaurants and bars up 0.6%, while home furnishing, electronics/appliances, sporting goods/hobbies, and clothing stores saw declines. We have seen a small shift since the beginning of the year to weakness in spending in discretionary categories like home items, to more consumer staple categories.

Company News

- Along with announcing its quarterly earnings results, which beat estimates but results in its Cloud and China commerce segments were below expectations, driving the stock lower, Alibaba said its board has approved a spin off of its Cloud Intelligence group via a stock dividend with the intention for it to be a standalone publicly traded company. This comes after a March announcement it would split the company into six different units in effort to boost focus and value in each group.

- Shares of Netflix gained last week after it reported the debut of its ad-supported service went better than expected. The new service offers a subscription at a cheaper price but includes ads. The company presented to advertising executives last week saying that it added 5 million monthly active users, while not disclosing actual subscriptions or revenue figures.

- The WSJ reported Disney is looking to sell ESPN directly to cable cord-cutters as a subscription streaming service in the next few years. The report says it could have a major impact on cable TV providers as they would then have to compete with the new streaming service. Currently, Disney offers ESPN+, a service to live programming but it does not include the channel ESPN that is only offered on TV. Data rfom S&P Global Market Intelligence shows the average fee Disney collects for ESPN from cable networks is $9.42 per cable bill.

- Separately, Disney said it will cancel its plans to build a $1 billion office campus in Florida that would relocate 2,000 of its California employees to the new location, citing changing business conditions amid its feud with Florida Governor DeSantis.

- The European Union fined Meta, parent company of Facebook, a record $1.3 billion for privacy violations due to its data transfers to the U.S. This comes after a recent $806 million fine, then a record, to Amazon for privacy violations.

- China’s cybersecurity review found that Micron’s products (memory chips) have serious network security issues and presents a cybersecurity risk and as a results have ordered a critical information infrastructure ban of Micron products. Micron later said after evaluation of how it would be impacted that it estimates revenues will be impacted by a low to high single digit percentage range, depending upon the definition of the ban.

Other News

- Debt ceiling negotiations ended Friday on a disappointing note with Republicans walking out of meetings at the White House stating Democrats were being unreasonable and saying they will be taking a “pause” on negotiations. However, late Sunday leaders from both parties met in DC for a couple hours which was followed by a call between Biden and McCarthy in which McCarthy noted as being “productive.” The latest news this morning states Biden and McCarthy plan to meet on Monday afternoon to continue discussions. Meanwhile, Treasury Secretary Janet Yellen warned again over the weekend that early June is a hard deadline and “the odds of reaching June 15 while being able to pay all of our bills is quite low.”

- Popular social media app TikTok faced its first statewide ban after Montana’s Governor signed a law that would prohibit the general public from downloading the app. The ban will go into place January 1, 2024, with many other states discussing the possibility of following in Montana’s steps. The Governor said in a tweet the ban was to “protect Montanans’ personal and private data from the Chinese Communist Party.”

- Central bank comments/news

- Chicago Fed president Goolsbee called the support for a rate hike two weeks ago a “close call” and acknowledged a lot of the impact from higher rates is yet to come. He emphasized his view on further rate increases will be data dependent. He sees inflation improving but not as rapidly.

- Atlanta Fed president Bostic said he does not believe rate cuts will happen this year, even if a recession hits later this year. He said if he has a bias for rates going up or down, he would have a bias on rates going higher. Additionally, Bostic said he thought the banking situation since March would cause “a lot more panic.”

- Minneapolis Fed president Kashkari said regarding the recent improving trend in inflation data that the Fed shouldn’t be fooled by a few months of positive data, adding inflation remains too high and the labor market remains strong though not as frothy as a few months ago.

- Richmond Fed president Barkin said if inflation persists, or accelerates, he would support further rate increases.

- New York Fed President Williams acknowledged inflation is moving in the right direction but remains “unacceptably” high, adding that the US is beginning to see supply and demand move back in balance.

- Dallas Fed President Lorie Logan said current data does not yet justify pausing interest rate hikes yet, saying “as of today we are not there yet,” raising concerns that inflation is not falling quickly enough adding that “we haven’t yet made the progress we need to make.” She said the upcoming data could show it is appropriate to not pause rate hikes yet.

- New Fed Governor Philip Jefferson said something that has been noted more frequently by policymakers that inflation “is still too high, and by some measures progress has been slowing.” He said outside of food and energy, progress on inflation “remains a challenge” and there have been no signs of a significant decline in services inflation where prices have been rising fast. He also added that it is too early to tell the full effects of policy tightening/higher rates.

- Chairman Powell spoke Friday at a Fed research conference in Washington in which he walked back recent public remarks by his fellow policymakers (above) and said tighter financial conditions from the banking turmoil may mean less rate increases ahead, giving a less hawkish message than recent comments. He reiterated the lag effect in rate increases, saying the Fed can “afford” to look at data prior to making its next decision. Powell added the “risks of doing too much or doing too little are becoming more balanced” with policy now reflecting that, which differs from earlier in the year when the risk was in doing too little and inflation staying high versus doing too much. Powell did remind his audience that a decision for the June FOMC meeting has yet to be made and overall his message was consistent with that from the May FOMC press conference.

Did You Know…?

Memorial Day Weekend Travel

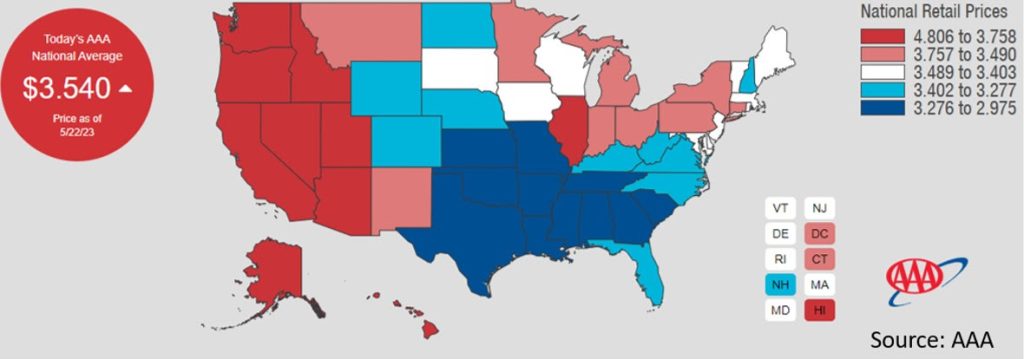

According to AAA and S&P Global, travel by Americans over the Memorial Day holiday weekend is expected to rise to the highest level since 2005. The projections show the number of passengers on domestic and international flights is expected to surpass pre-pandemic levels by over 5% with as many as 42 million people traveling at least 50 miles from home over the holiday weekend. This would represent a 7% increase from the holiday weekend in 2022. Vehicle travel is still down from pre-pandemic levels, but lower gasoline costs is expected to help increase the demand for travel by car. The average gas price in the US is $3.54/gallon as of May 22, which is 23% lower from the average $4.59 this time last year. At the same time, the average airfare is down 1% from April 2022 to April this year, but 32% higher than two years earlier and 10% higher than pre-pandemic levels.

WFG News

Office Hours

Please be aware that starting after Memorial Day and running until Labor Day, Wentz Financial Group will begin its summer hours. Our hours will be 8:30 to 4:00 Monday through Friday. As always, if you need to speak or meet outside of those hours, please reach out and we will be happy to set up an appointment.

The Week Ahead

This week’s earnings reports will revolve around more retail companies and several from the tech sector. Notable companies reporting first quarter results this week include ZoomVideo on Monday; Lowe’s, BJ Wholesale, Dick’s Sporting Goods, AutoZone, Intuit, Palo Alto Networks on Tuesday; Kohl’s, Snowflake, Nvidia on Wednesday; and Best Buy, Dollar Tree, Ulta Beauty, Ralph Lauren, and Costco on Thursday. There are many investor day and shareholder meeting this time of year and this week will see ones from JPMorgan and Ford. The economic calendar will have several key reports. More data on the housing market with new home sales, where current estimates show a relatively unchanged level of sales for April, come out Tuesday. The results from the second revision of first quarter GDP along with weekly jobless claims are released Thursday, and Friday includes April durable goods orders, the final May consumer sentiment survey, and consumer income and spending data, which will include the PCE price index, a popular inflation measure. On the Fed front, there will be more public speeches from Fed policymakers, mostly the beginning of the week, along with the release of the minutes from the Fed’s meeting May 3. Finally, the debt ceiling will surely continue to be in the headlines with Congress just ten days away from the “x-date” when the government is estimated to run out of money and default on its debt.