Wentz Weekly Insights

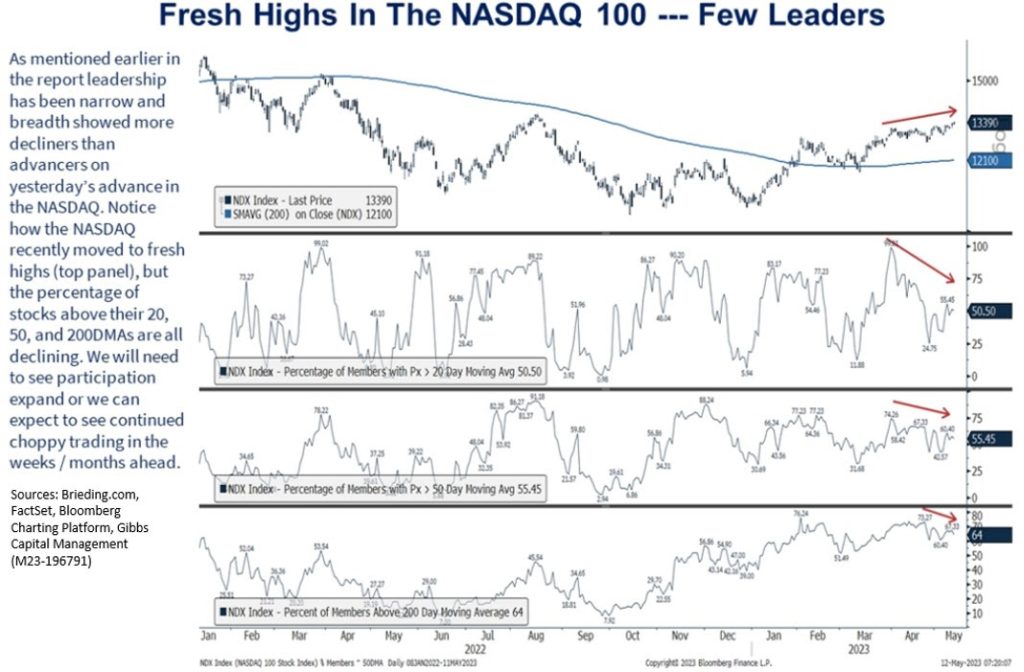

Indexes Up Although Driven by Few Leaders as the Average Stock Still Down

Recent Economic Data

- Consumer inflation in April was right in line with expectations across the board. The consumer price index rose 0.4% in the month, up from a 0.1% increase in March due to a 0.6% rebound in energy prices (+3.0% for gas) as well as a 4.4% increase in used cars. Excluding the food and energy categories, core prices rose 0.4%. The shelter category, which has been the main driver of inflation over the past year, saw a 0.4% increase which was the lowest monthly increase since January 2022 and gives markets hope inflation will move down quicker. Medical care services fell for the sixth of the past seven months as insurance costs continue to decline, down 3.8% (due to the ‘new’ calculations), while medical goods rose 0.5%. Transportation service costs fell as airfare dropped 2.6% for the first decline in months. Compared to a year ago prices are up 4.9%, decelerating from 5.0% last in March while core prices are up 5.5%, down from 5.6% in March.

- Input prices for producers rose 0.2% in April, slightly less than the 0.3% increase expected and picking up from the 0.5% decline in March. The March decline was due purely to a drop in energy prices, while the increase in April was a little more broad, with the foods and transportation/warehousing categories the only major categories seeing declines. Core prices, which look at final demand prices for producers excluding food, energy and trade, rose 0.2% as well, meeting expectations. The producer price index was up 2.3% from a year ago at the headline level, down from 2.7% in March, and up 3.4% for core prices, down from 3.6% in March.

- Prices of goods/services imported to the US increased 0.4% in April, the first monthly increase since December, however prices of imports are down 4.8% from 12 months earlier, a sharp difference from this time last year when import prices were climbing at a record pace. April’s increase was driven by increases in fuel, as the index excluding fuel was unchanged in the month. US export prices increased 0.2% in April, the third monthly increase in the past ten months, with the 12 month decline in export prices at 5.9%, again after record increases this time last year. The increase was a little more broad based but mostly driven by a 0.4% increase in agricultural goods.

- The Fed bank of NY survey of consumer expectations showed consumer’s inflation expectation fell 0.3% over the next 12 months compared to the March survey to 4.4%, while three-year ahead inflation rose 0.1% to 2.9%. More consumers thought unemployment would rise while expectations for income and spending fell, with spending growth expectations falling to 5.2% from 5.7% for the lowest reading since September 2021.

- The Atlanta Fed business inflation expectation survey showed inflation expectations for businesses ticked higher, to 2.9% over the next year, up from 2.8% in last month’s survey. On the current environment, businesses said sales levels “compared to normal” have decreased while unit costs increases were unchanged in the month at 3.5% on average.

- For the week ended May 6, the number of jobless claims filed was 264,000, an increase of 22k from the prior week and now the highest since October 2021 when they were trending downward from the Covid spike. The four-week average was 245,250, up 6k from the prior week. The number of continuing claims was 1.813 million, up another 12k with the four-week average now at 1.829 million.

- The preliminary read on May Consumer sentiment, an index compiled by the University of Michigan based on a survey of consumers, was 57.7 which was down from 63.0 in April’s final print. The index on current conditions has fallen to 64.5 for the weakest since December, below expectations and down from 68.6 in April. The index on expectations was a bigger disappointment, falling to 53.4 which was well below expectations and down from 60.5 in April. One-year ahead inflation expectations ticked lower to 4.5% from 4.6% (which was up from 3.6% the prior read), while 5-10 year ahead expectation on inflation moved higher again, increasing to 3.2%, the highest since 2008 and not a welcoming sign for the Fed.

- Per the weekly Freddie Mac mortgage survey, the average prime 30 year mortgage rate was 6.35% last week, down slightly from the week prior but has remained in this 6.10% – 6.60% range since November.

Company News

- PacWest, a regional bank on the west coast which has been speculated to be the next bank to fail, said it lost another 9.5% of its deposits in the week ending May 5. In addition, it said it pledged another $5.1 billion of loans to the Fed to allow an additional $3.9 billion in borrowing.

- The European Commission approved Microsoft’s proposed acquisition of Activision Blizzard, conditional upon the full compliance with the commitments Microsoft had offered. The EC said the commitments fully address the competition concerns it had and represents improvement for cloud gaming. UK’s antitrust regulators had previously blocked the deal while the companies have hired attorneys to counter UK’s decision.

- Facebook parent company Meta said it is testing an advertising expansion on Reels that would give creators the ability to earn money on the performance of their Reels, a move Facebook thinks will create further engagement.

- In M&A news, there was a big deal in the lithium mining space – Chemical maker Livent will combine with lithium miner Allkem in an all-stock deal valuing the combined company at $10.6 billion. Allkem will own 56% of the new company and Livent shareholders will own 44%.

- Twitter CEO Elon Musk said the company has hired a new CEO and will start in six weeks. Reports from the WSJ say the new CEO will be current NBCUniversal advertising Chief Linda Yaccarino, who oversees the company’s advertising and partnerships at NBC. She has been an advocate in the industry for finding better ways to measure ad effectiveness. Later in the week, Yaccarino announced she was resigning from her position at NBC.

- Goodyear Tire saw gains last week after activist investor Elliott Management said it built a stake in the stock and plans to seek five board seats, push the company to begin an operational review to improve its margins, and push for ways for the company to monetize its Goodyear retail store network, including a sale of the network of retail locations.

- Franchise Group, owner and operator of franchises such as Vitamin Shoppe, Pet Supplies Plus, and American Freight announced it has agreed to be taken private by consortium led by its management group and its CEO as well as B. Riley Financial and Irradian Partners in a deal for $30/share, representing a 31% premium to shares before the deal was announced.

Other News

- Brokerage firm Robinhood said it would be the first retail brokerage to offer trading 24 hours per day Monday through Friday, but will only include a list of 40 popular stocks and ETFs.

- The Senior Loan Officer Opinion Survey on Bank Lending Practices, which received attention after Powell mentioned it at the last Fed meeting, showed banking credit standards tightened since January. Respondents noted tighter standards and weaker demand for commercial loans and household loans for all loan categories, but was actually unchanged for credit cards. There were a couple special questions – about banks changes in lending policies for commercial real estate loans which they said it was due to banks’ higher costs of funds and lower loan-to-value ratios. Regarding tightening standards for all loan categories respondents cited less favorable economic outlook, reduced risk tolerance, deterioration of collateral values, and concerns about banks’ funding costs and liquidity positions. Regarding how respondents see the outlook, they said they expect further tightening across all loan categories, citing the same as the previous questions and including deposit outflows.

- The debate on the debt ceiling continued over the week with a scheduled meeting at the White House postponed on Friday to Tuesday this week to reportedly give staffers more time for negotiations, according to the AP. Shortly before the postponement, House speaker McCarthy dismissed the possibility of a short term extension to the debt limit, still preferring a longer-term solution. This comes after reports, including the White House saying it was looking at the possibility of a short-term extension. Meanwhile, the Congressional Budget Office, a non-partisan agency, said the Treasury will face a cash crunch in June but if it can get through June it can make it through the end of July before it reaches the debt limit.

- Reuters reported Energy Secretary Granholm said the process of buying crude oil to restock the US’s Strategic Petroleum Reserve could start in June. Last year, Biden announced a massive draw that occurred through the middle of the year that depleted a large chunk of what was stored in the reserve and there has been speculation it would begin to be refilled soon. Reuters says the administration has signaled previously it would look to refill the SPR when oil prices are consistently below $67-$72/barrel. Prices have been in a tight range of roughly $68-$80/barrel since November.

- Central Bank Headlines:

- NY Fed president Williams said he is now “particularly focused” on banks and how tighter credit conditions will impact economic activity and inflation, which he says is uncertain at this point. He added he does not see any reason to cut rates this year as the labor market still remains very tight.

- Chicago Fed president Goolsbee said it is too premature to tell what the FOMC will do at the next meeting with interest rates. He said the credit squeeze is beginning and the Fed needs to see how much work that is doing to monetary policy

- Fed Governor Michelle Bowman said it will “likely be appropriate” for the Fed to raise interest rates further as the latest inflation and labor market data have not provided the “consistent evidence” that is needed to assure her inflation is on a downward path. She said the next meeting will be data dependent on what moves the Fed makes.

- The Bank of England raised its policy rate by 25 basis points (to 4.5%), as expected, while signaling further rate increases will continue to be necessary. Its base case no longer sees a recession, however the risks to inflation remain to the upside. There was little reaction in financial markets as this was widely expected.

- The European Central Bank’s consumer expectations survey showed one-year ahead expectations on inflation rose to 5.0% from 4.6% in the previous month’s survey. Meanwhile, longer-term inflation increased to 2.9%, a jump from 2.4% in the previous survey.

Did You Know…?

More Consumer Debt

WFG News

Office Hours

The Week Ahead

This week ahead will have a focus on the retail sector. On the economic calendar, retail sales for the month of April will be released on Tuesday. After a 1.0% decline in March, economists are expecting sales bounced back with a 0.7% increase in April, but may be mostly due to vehicles and gasoline sales. Several housing indicators come out as well including the housing market index on Tuesday, housing starts and permits on Wednesday, and existing home sales on Thursday. Elsewhere, the Empire State Manufacturing and Philly Fed manufacturing survey indexes come out Monday and Thursday respectively, where we know the sector has shown weak activity for almost a year now, industrial production on Tuesday, and jobless claims on Thursday. There will be more Fed speak this week with Chairman Powell’s speech on Friday capping off the week. Earnings include many big box retailers. Among the notable names include Home Depot on Tuesday; Target, Cisco, TJX on Wednesday, Walmart, Ross Stores, Alibaba on Thursday, and Deere and Foot Locker on Friday. Debt ceiling debate continues with Congressional leaders scheduled to meet at the White House on Tuesday to continue negotiations.