Wentz Weekly Insights

First Quarter Ends with 10% Gain

It was a very quiet and calm week for markets with no notable events driving stocks either direction. With a lack of catalysts and many on spring break, volume and volatility were low and the path of least resistance remained higher for stocks. The outperformance this time came from small caps with the Russell 2000 gaining 2.5% as some of the mega caps saw small declines, leaving the S&P 500 with a small gain for the week, and ending the month of March positive for the fifth consecutive month. In fact, the first quarter saw a gain of 10.16% for the index, the second straight double digit quarterly gain and the best start to the year since 2019.

This came despite some push back against cutting rates too soon from several Fed policymakers. Governor Christopher Waller made remarks last week that reflected this view. He said there is no rush to cut interest rates, it may be “prudent to hold rates” longer than previously thought, adding that some of the price trends (inflation data) have been disappointing and the data received so far this year “has made me uncertain about the speed of continued progress.” He added “I am going to need to see a couple more months of inflation data before I have enough confidence that beginning to cut rates with keep the economy on a path to 2% inflation.” This seems to be a trend lately, but markets are unfazed, rather more focused on the strong economic data that points to a strong economy that is able to handle higher rates.

The most anticipated event was Friday’s release of the personal income and outlays data that included the PCE price index, the Fed’s preferred inflation reading, but markets were closed and not able to react to that until this week. The data showed no surprises, with the inflation numbers coming in exactly as expected.

First, the data showed personal income rose 0.3% in the month, after rising a strong 1.0% in January, most likely the effects from cost of living adjustments for the new year – for example transfer payments (like social security, veteran benefits, etc) increased 2.8% in January, then just 0.6% in February. The most important part of incomes, wages and salaries, increased a strong 0.8% in February, after just 0.3% increase in January.

Meanwhile, consumer spending increased a robust 0.8% in February, after just a 0.2% increase in January, which some saw as signs of a weaker consumer while others saw it as effects from the bad weather in January. In February the 0.8% increase came from a 0.5% increase in spending on goods and a 0.9% increase in spending on services.

Spending on services has remained very strong since the economy normalized from the pandemic, and one of the reasons inflation has remained so sticky within services.

The focus for markets was the PCE price index, which puts less of a weighting on shelter (housing costs), than the consumer price index does. The PCE index increased 0.3% in February and was up 2.5% over the past 12 months, although slightly more than the 2.4% 12 month increase in January, it still met expectations. Meanwhile, the core PCE index, which excludes food and energy costs, increased 0.3% in the month as expected and up 2.8% over the past 12 months, slightly lower than 2.9% from January.

The Fed’s target for inflation is 2.0% and the data shows there is continued progress toward meeting that target, although the progress has slowed in recent months. That is why markets have been focused on the recent data – to confirm progress continues to be made and the Fed can begin cutting interest rates, or showing progress has stalled and rates should stay higher for longer. The upcoming Fed speak this week should tell us more on how Fed policymakers have viewed the recent data and its impact on policy. However, we don’t expect the view has changed much – interest rate cuts will begin (very slowly) in the second half of the year.

Week in Review:

It was a pretty quiet week in the markets and the path of least resistance for stocks remains to the upside, with the major US indices finishing as follows: Russell 2000 +2.54%, Dow +0.84%, S&P 500 +0.39%, and NASDAQ -0.30%. Treasuries were relatively unchanged with the 2-year Treasury finishing at 4.63% and the 10-year’s yield at 4.21%. Gold reached another new all-time high after a 3.6% increase for the week, while the dollar index rose 0.1%, but the big story in currency is the Japanese yen falling to the lowest since 1990. Crude oil had another positive week, its third in a row, rising 3.2% for the week over Russia’s decision to cut production to meet OPEC’s production obligations, but natural gas fell to the lowest price level since mid-2020 over more mild weather and oversupply.

Recent Economic Data

- New Home Sales: The number of new home sales in February was at a seasonally adjusted annualized pace of 662,000, relatively unchanged from January but 6% above February 2023’s sales pace. The sales pace of new homes has ranged between 625k and 725k over the past year and compared to the trend of about 700k prior to the pandemic and a high of 1 million during the pandemic when demand surged. New home sales are based on signed contracts so reflects sales in February when the mortgage rate went back over 7% and stayed there, versus dropping into the 6% range the prior two months. The supply of new homes rose 1% to 463,000, equaling 8.4 months’ supply at the current sales pace, while the median selling price fell 2.3% to $419,800 and is down 3% over the past year.

- Case Shiller Home Price Index: The S&P Case-Shiller home price index reported a 0.4% increase in home prices in January (declined 0.1% not seasonally adjusted). Just 11 of the 20 cities tracked saw price increases in the month but overall, prices did reach a record high for the eighth consecutive month. Over the past year, home prices have increased 6.0% with the largest increase in San Diego (+11.2%), Las Angeles and Detroit (+8%), and smallest increase in Portland (+0.9%), Denver (+2.7%), and Dallas (+2.9%), and Cleveland remaining in the middle at +6.9%.

- Durable Goods Orders: New orders for durable goods rose 1.4%, bouncing back after a 6.9% decline in January. Durable goods orders have been pretty volatile lately and the aircraft category is all to blame, where orders rose 25% in February but declined 64% in January. Excluding aircraft, orders were up 0.5%, after a small decline the prior two months. The number that goes into GDP, shipments of nondefense core capital goods excluding aircraft, fell 0.4%, after a 0.8% increase in January.

- Consumer Confidence Index: The Conference Boards consumer confidence index was relatively unchanged in March at 104.7. The index on the present situation increased 4 points to 151.0 while the index on expectations fell 3 points to 73.8. An expectations index below 80 often signals a forthcoming recession, according to the report.

- Jobless Claims: The number of unemployment claims the week ended March 23 was 210,000, a slight decline from the prior week, with the four-week average at 211,000. The number of continuing claims was 1.819 million, up 24k from the prior week, with the four-week average at 1.803 million. Both figures have been in a tight range since around fall last year.

- Consumer Sentiment Survey: The consumer sentiment index saw a big jump in March, rising to 79.4 for the best level since July 2021. The current conditions index rose to 82.5 while the expectations index rose to 77.4, both the best since July 2021. For comparisons purposes, the headline index ranged from 90 to 105 the two years before the pandemic, fell to 72 during the pandemic lockdowns and only reached a high of 88 after the pandemic before falling to an all-time low of 50 mid-2022. The expectation on inflation for the next year was 2.9%, down slightly from 3.0% last month while five-year inflation expectations inched down to 2.8% from 2.9%.

- Money Supply: The US money supply (includes cash, deposits at banks, money market balances, etc) fell $6.6 billion, or less than 0.1% in February, and is down $351 billion, or 1.7%, from a year ago. Recall that due to money printing and substantial stimulus during the pandemic, the money supply rose $6 TRILLION from February 2020 to the high of $21.7 trillion in April 2022. This is quietly a big contributor to inflation (too much money chasing too little goods/services). Since then, the money supply is down $931 billion, or 4.3%. This was by far the biggest increase in the money supply and now the largest decline in the money supply. Many believe this will lead to a recession, as past recessionary periods were met with declines in the money supply.

Company News

- Donuts At McDonald’s: McDonald’s and Krispy Kreme announced a partnership with McDonald’s selling Krispy Kreme donuts, beginning a rollout in the second half of 2024 and a national rollout by 2026. Krispy Kreme will deliver fresh donuts each morning and will be sold through the day while supplies last. The expansion comes after a successful test at about 160 McDonald’s where it saw demand that exceeded expectations.

- AMD & Intel Chip Ban?: Shares of Intel and AMD saw pressure last week after reports said China is introducing new policies that would ban chips from AMD and Intel in government PCs and servers.

- Apple’s Developer Conference: Apple said it will host its annual Worldwide Developers Conference the week of June 10. Citing sources, Bloomberg reported the conference this year will focus heavily on Apple’s AI strategy, which has been highly anticipated.

- Home Depot Acquisition: Home Depot is making a bet on the pro business by acquiring SRS Distribution, a specialty residential trade distribution company, for about $18.25 billion. SRS has over 2,500 professional sales force and Home Depot sees it as a way to accelerate growth in the residential professional customer while making it a major specialty trade distributor.

Did You Know…?

Cocoa Prices:

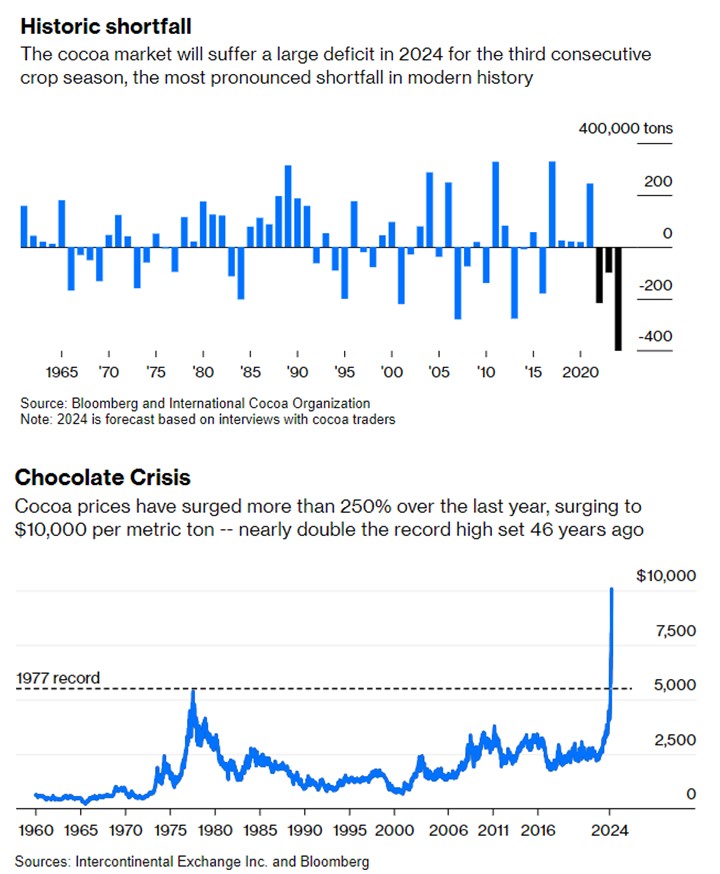

Its not a commodity price most people track daily, but cocoa prices have surged over the past several months. Last week, the price of cocoa futures spiked above $10,000 per metric ton for the first time ever, and almost double the previous record set almost 50 years ago, as reported by Bloomberg. In just the first two days last week, the price increased more than $1,000 per metric ton, a range that typically is seen over a multi-year period. The sudden and dramatic rise in the commodity is and supply and demand issue where diseases and bad weather in West Africa, which produces roughly 70% of the world’s cocoa, have caused one of the largest shortfalls in supply ever. Short covering has also had an impact on prices – those holding inventory in cocoa hedge their position by taking on short bets, combined with traders, have had to close out their positions through buying futures, therefor pushing prices even higher. The first chart below illustrates the shortfall in cocoa this year of almost 400,000 metric tons, while the bottom chart shows the price of cocoa over the since 1960.

WFG News

The Week Ahead

With the calendar turning to a new month the economic calendar will include updates on the labor market for March. The highlight of the week is the Department of Labor’s employment report on Friday where consensus estimates see another 200,000 job gains. Other data on the labor market includes the job openings and labor turnover survey, ADP’s employment report, and jobless claims. Other non-jobs market data includes the PMI and ISM manufacturing indexes and construction spending on Monday, factory orders Tuesday, the ISM services index Wednesday, and trade data Thursday. We are in one of the lightest weeks of earnings reports, with the only notable reports coming from Conagra Brands, PVH, Levi Strauss, and Blackberry, before Q1 earnings season starts next week with the big banks. The calendar is loaded with scheduled Federal Reserve speakers, with Chairman Powell speaking Wednesday afternoon. In addition, OPEC holds its policy meeting on Wednesday but there is no expectation of any big announcement for oil production.