Wentz Weekly Insights

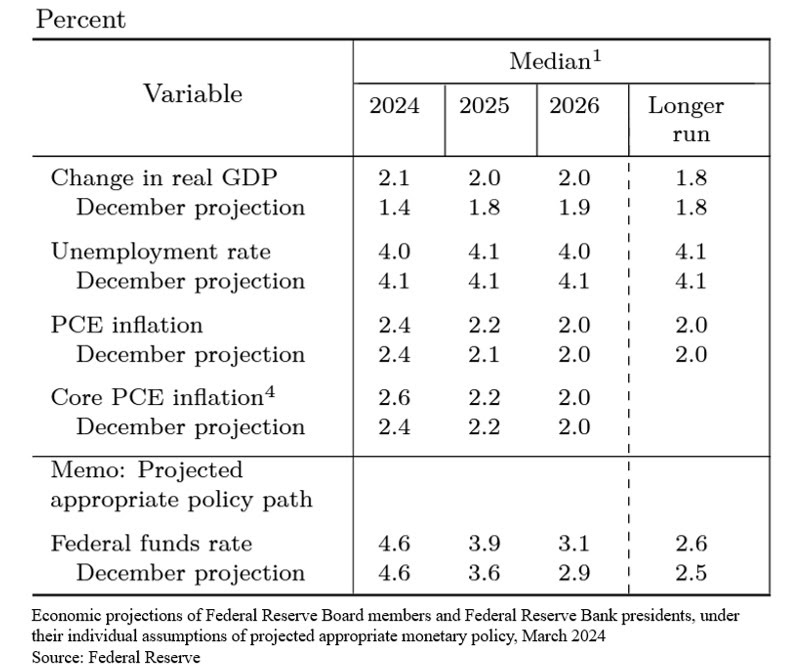

Fed Maintains View of Three Rate Cuts in 2024, Markets Move Higher

Recent Economic Data

- Index of Leading Economic Indicators: For the first time since February 2022, the index of leading economic indicators turned positive with a 0.1% monthly increase for March. The index is a composite of ten forward looking economic releases including data such as weekly jobless claims and building permits for homes. Its purpose has been to predict economic conditions several months forward.

- Housing Market Index: The housing market index, an index of homebuilder sentiment, rose 3 points to 51 for March, the fourth consecutive monthly gain, the highest level since July and the first time above 50 (the breakeven level – anything over that reflects positive sentiment) since then. The present situation index rose 4 points to 56, sales expectations over the next six months rose 2 points to 62, while traffic of prospective buyers rose 2 points but still at a very depressed level of 34.

- Housing Starts: The number of housing starts in February was at an annualized rate of 1.521 million, a large jump of 10.7% compared to January’s pace, and 6% above the pace from February 2023. The increase was driven by single family starts. The number of permits for new home builds was at an annualized rate of 1.518 million, about 2% above January and February a year ago. For comparison purposes, the number of starts trended around 1.350 million pre-pandemic and peaked at 1.800 million after the pandemic in 2022. Also of note, the number of new homes authorized to be built, but not yet started has steadily increased over the past year, up to 301k which is a 11.5% increase from a year ago level of 270k.

- Existing Home Sales: The number of existing homes sold in February unexpectedly rose 9.5%, the largest monthly increase in over a year, to a seasonally adjusted annualized pace of 4.380 million homes. This is an improvement of 3.3% from February 2023. Sales of existing homes are measured by closings so this reflects contracts signed in December and into January when rates were near the lowest level of the past 8 months (now up half a percent since). Inventories improved somewhat, up 5.9% in the month and now up 10% form a year ago to 1.07 million existing homes, equivalent to 2.9 months’ supply at the current sales pace. There was a new all time high in prices too, the median price rose 5.7% from a year ago to $384,500. Realtors are starting to see buyers are getting used to a “new normal”.

- Mortgage Rates: The average prime 30-year mortgage rate climbed 13 basis points last week to 6.87% and up 45 bps from a year ago, according to the Freddie Mac Mortgage survey. The peak in the 30-year rate was 7.79% back in October.

- Jobless Claims: The number of unemployment claims the week ended March 16 was 210,000, relatively unchanged from the prior week with the four-week average up slightly to 212,000. The number of continuing claims was 1.807 million, up slightly, with the four-week average at 1.802 million, also up only slightly.

- Philly Fed Manufacturing Index: The Philly Fed Manufacturing survey index was 3.2 for March, roughly the same as February, better than a negative read that was expected, and reflecting much better conditions than what the Empire State Manufacturing Index suggested last week. The report showed new orders turned positive, employment remained negative, but optimism with future activity index improving, while only 24% of firms reporting increases in general activity, 21% reporting decreases, and 52% reporting no change.

Company News

- Apple Licensing Google’s AI?: Shares of Google parent company Alphabet were higher last week after a Bloomberg report said Apple is in discussions with Google to build Google’s artificial intelligence engine, Gemini, into Apple’s iPhones. The agreement would let Apple license Google’s generative AI models to power its new AI related features coming to the iPhone this year. The report added Apple has also held discussions with OpenAI, who has been partnered with Microsoft. The deal would provide Google’s Gemini more exposure but may also be a sign Apple is not as far with its AI efforts.

- JoAnn Fabrics Bankruptcy: The Hudson, Ohio based fabric and craft retailer JoAnn Inc filed for Chapter 11 bankruptcy last week. It said it expects to emerge from bankruptcy as early as next month and become privately owned by “certain lenders and industry parties.” The filing said it had more than $2.4 billion in debts and about $2.26 billion in total assets.

- Temu’s Effect: The online shopping platform Temu, owned by Chinese company Pindoudou, said it is aiming to dial back its reliance on the US consumer. It is estimated about 60% of its gross merchandise sales come from the US and it is making it a goal of reducing that to around 30%. As a result, shares of Meta and Alphabet saw weakness as Temu has been one of their largest advertisers lately.

- Grants to Intel: The White House officially announced it has awarded Intel $8.5 billion in grants and $11 billion of potential loans through the CHIPS Act to advance its semiconductor projects in the US.

- Boeing’s M&A: A Reuters report said Boeing is looking at ways to sell Spirit AeroSystems businesses that supply to Airbus in the event Boeing purchases Spirit, which was reported it was looking into doing so several weeks ago. Spirit’s Airbus business generates about 20% of its revenue and the sources say Boeing does not want to own that part of the Spirit business. It is also worried European regulators would have issues with Boeing supplying its main competitor. In addition, Bloomberg reported Boeing is looking at possibly selling at least two of its smaller businesses in the defense, space, and security unit to strengthen its balance sheet.

- Boeing’s Updated Guidance: Separately, Boeing said its free cash flow will be much less than expected in the first quarter (-$4.5 to $-4.0 billion versus -$1.5 billion consensus) due to the less aircraft deliveries and higher working capital after the emergency door blew out on an Alaskan flight in January.

- DoJ Lawsuit Against Apple’ Monopoly: A report by Bloomberg says the US Justice Department is getting ready to file a lawsuit against Apple as soon as today, accusing it of violating antitrust laws by preventing rivals from accessing iPhone features including hardware and software, its first case accusing Apple of illegally maintaining its dominant position. Regulators have recently attempted to crack down more on big tech, with an ongoing DOJ lawsuit against Alphabet (Google) and Federal Trade Commission lawsuits against Meta and Amazon.

Other News

- Saudi Arabia’s AI Fund: Saudi Arabia is planning to create a $40 billion fund to invest in artificial intelligence technologies and would make it the world’s largest investor in AI, according to the New York Times. It said the Saudis are serious about investing in the technology as it sees it reshaping industries and has been discussing potential partnerships with several large US private venture capital firms. The Saudis would pursue the investment by drawing from its sovereign wealth fund, which currently has assets worth around $900 billion.

- Congress Comes to An Agreement: Roughly half a year into the US government’s fiscal year, Congress finally reached a deal on a spending package through September that avoids a government shutdown. This permanent budget plan comes after months of negotiations and dozens of failed attempts since last year with several stop gap bills to keep the government temporarily funded. The $1.2 trillion package includes six appropriation bills that funds a variety of government agencies.

- Central Bank Headlines:

- In its latest policy meeting last week, the Bank of Japan raised its benchmark interest rate by 0.1%, its first rate increase in 17 years, ending its negative interest rate policy and the last major central banks in the world to raise rates. In addition, it said it would end its yield curve control policy – A policy that started in 2016 where it would buy unlimited amounts of Japanese government bonds to keep its yield to a certain percentage, it was initially at 0%, but they allowed it to float as high as 1% recently, now ending the cap. It will also end its program of buying risk assets such as ETFs, REITs and phase out its purchases of corporate bonds. These decisions were expected with media press releases in the days leading up to the decision.

- The Bank of England left rates unchanged and is basically in the same spot as the Fed – indicating it will cut rates soon. It saw an 8-1 vote with one official voting to cut rates, a difference from a 6-3 vote in its prior meeting where two voted to raise rates again.

- Meanwhile, the Swiss National Bank surprisingly cut rates by 25 basis points to 1.5%, becoming the first central bank in a developed economy to cut rates this cycle.

Did You Know…?

Higher Tax Refunds

WFG News

The Week Ahead

It will be a holiday shortened week with markets closed on Friday in observation of Good Friday. Investors’ main focus will be on the momentum with tech/AI related stocks as well as the next inflation read on Friday in the PCE price index, the Fed’s preferred reading. The index is expected to have risen 0.4% in February with a 2.8% annual increase in core prices. Other economic data releases include new home sales on Monday, durable goods orders, consumer confidence, and the January Case-Shiller home price index on Tuesday, jobless claims, pending home sales, the consumer sentiment index on Thursday, and personal income and outlays on Friday that includes consumer spending, personal income figures, and the price index. On the Fed side, there will be a number of Fed officials making public appearances this week where markets will look for any follow up comments after last week’s Fed meeting, including a moderated discussion which Chairman Powell will attend Friday morning. The earnings calendar is very light, but still a couple notable reports from McCormick, Carnival, and Walgreens. The corporate calendar also includes several investor events that may bring company updates.