Wentz Weekly Insights

The Fed and Nvidia

Recent Economic Data

- Consumer Price Index: The consumer price index rose 0.4% in February, as expected and increased 3.2% over the past year, slightly more than the 3.1% expected and 3.1% annual pace seen last month. However, the past three months annualized is 4.0%, double the Fed’s 2% target. Core prices were a little more than expected, the index excluding food and energy rose 0.4% and is up 3.8% from a year ago, more than the 3.7% expected but decelerating from 3.9% last month. Looking at the details, food prices were unchanged (up 2.2% from last year) while energy prices saw a 2.3% increase, though still down 2% over the past year. On goods, apparel rose 0.6%, used vehicles rose 0.5% (still down 2% over the past year) while new vehicles fell 0.1%, medical commodities rose 0.1%. The pace of increase in the shelter category ticked lower to 0.4% though still up 5.7% from a year ago. Medical care services fell slightly while transportation services saw another big increase of 1.4%, and remains one of the hottest categories up 10% over the past year. One of the more important index readings, “super core” which looks at services prices, rose 0.6% in the month and is still up 3.9% over the past year and up 6.4% over the past three months annualized.

- Producer Price Index: Producer inflation was hotter than expected in February for the second consecutive month. The producer price index rose 0.6% in the month, double the 0.3% expected, and is up 1.6% from a year ago, accelerating from the annual rate of 0.9% in January. Core prices, excluding food and energy categories, rose 0.3%, also more than expected, and up 2.0% from a year ago. Much of the higher prices in February came from energy and goods, with just a 0.3% increase in services, although service prices are still up an annualized pace of 4.8% over the past two months.

- Retail Sales: Retail sales saw a big decline in January, which some blamed to bad weather, but that was revised even lower to a 1.1% decline. February was expected to see a bounce back of 0.7%, but the latest data showed retail sales rose 0.6%, and 0.3% excluding vehicle and gasoline sales. Of the 13 major categories, 8 of them saw an increase in sales led by building supplies/gardening up 2.2%, vehicles up 1.6%, electronics up 1.5%, and declines in furniture stores, clothing, personal care, and online sales. The only figure on the services sector, bars and restaurants, rose 0.4% and still the hottest category over the past year with sales up 6.3%. Overall retail sales are up just 1.5% over the past year, and adjusted for inflation have declined nearly 2%.

- Jobless Claims: Jobless claims were relatively unchanged in the latest week with new unemployment claims coming in at 209,000 for the week ended March 9. The four-week average stayed at 208,000. The number of continuing claims have been a different story, rising to the highest level since the pandemic in November, but falling about 100k since, and last week rose slightly to 1.811 million. The four-week average increased slightly to 1.799 million.

- Industrial Production: Industrial production rose 0.1% in February after a decline three of the past four months. The small gain was due to a 0.8% increase in manufacturing, bouncing back after a big decline in January, a 2.2% increase in mining, also bouncing from a big decline in January, and a big 7.5% decline in utilities, which is driven by weather and the decline comes after a big increase in January from being a colder month.

- Empire State Manufacturing Survey: The Empire state manufacturing survey index was -20.9, a massive miss on the downside versus expectations, falling deeper into contraction territory from -2.4 in February. This index has rarely been above zero over the past two years. The report noted the survey showed a significant decline in new orders and lower shipments, along with weakened labor market indicators and a moderation in the pace of input price increases but selling price increases that held steady.

- Consumer Sentiment: University of Michigan’s survey of consumer sentiment reflected little change in March compared to the February survey with consumer’s feelings on the economy steady since the beginning of the year. The index came in at 76.5, down slightly from 76.9 in February. The index of the current conditions was unchanged in the month at 79.4 while the index of consumer expectations fell slightly to 74.6, down from 75.2. Meanwhile, the expectation for inflation over the next 12 months was unchanged at 3.0% with longer term expectations unchanged as well at 2.9% for the fourth straight month.

Company News

- Southwest, American, and Delta: Airline stocks were off to a slow start last week after a presentation from multiple airline executives at a brokerage conference that included downward revisions to 2024 financials and comments of less Boeing plane deliveries. Southwest had a downward adjustment to its guidance on revenue per available seat mile and projecting a net loss in the quarter due to lower than expected leisure passenger volume. It also said its capacity will not grow as much as expected due to less deliveries of Boeing planes than anticipated due to the ongoing quality issues at Boeing, after Boeing told it to expect less deliveries this year. American is forecasting a bigger net loss due to higher fuel costs, while Delta’s update was better, reaffirming its profit forecast but not expecting deliveries of the 737MAX model until 2027, up from 2025.

- Trouble at Boeing: Separately, Boeing was a big topic in the markets last week due to its ongoing quality issues. The NY Times reported the latest FAA audits of Boeing, which came after the midair occurrence of an emergency door plug blowout, found the plane maker failed 33 of 89 product audits and 97 cases of non-compliance were recorded. In addition, European regulators said they would pull the approval of Boeing’s planes if warranted.

- TikTok’s Potential Ban: The possibility of a TikTok ban in the U.S. has resurfaced after the House passed a bill in a 352-65 decision that would ban the social media platform, which is owned by Chinese company ByteDance, unless it the company divest the business. It moves to the Senate but is expected to stall there with Senate leader Mitch McConnell hesitant on bringing it to a floor vote. One of the issues for the Senate is the bill singles out TikTok rather than a wider policy on restricting all apps that pose national security risks, as well as First Amendment concerns from several Senators. If it passes the Senate, President Biden has already said he would sign the bill.

- Microsoft & Oracle Buying TikTok?: Shortly after the House passed the bill, a report said Microsoft and Oracle were considering acquiring TikTok and have been working with investment bankers. It adds that it would only purchase TikTok if it included its source code, which is the algorithms and data that generates the content for users and is the main asset that potential acquirers are most interested in. The uncertainty is if China would allow a US company to acquire the source code. In addition, ex-U.S. Treasury Secretary Steve Mnuchin said he is putting together a group of investors in attempt to acquire TikTok, saying it is important for TikTok to remain in business as a competitor to those like Facebook, Snap, etc, and shouldn’t go under control of a larger company to avoid antitrust issues.

- US Steel Deal in Jeopardy: Shares of US Steel fell roughly 15% after President Biden said he expresses serious concern over the pending acquisition of US Steel by the Japanese steelmaker Nippon Steel. After the news, Nippon said it remans committed to the purchase despite the concerns. Also, Cleveland Cliffs, who was previously interested in a deal and made an offer, said it would consider buying the company in the $30s per share range.

Other News

- #1 Oil Producer: In 2023, the US produced more crude oil than any other nation at any time, according to the Energy Information Administration. US crude oil production set a new record in 2023, producing a total of 12.9 million barrels of oil per day, more than the previous record of 12.3 million bbl/day set in 2019. In addition, the US was the top oil producer for the sixth consecutive year. The second and third largest oil producing countries last year were Russia and Saudi Arabia, producing 10.1 million bbl/day and 9.7 million bbl/day, respectively.

- Strong Oil Demand: Separately, oil reached a new four month high after the International Energy Agency raised its oil demand forecast for 2024 while forecasting a supply deficit. It had previously forecasted a oil surplus for 2024 but adjusted its forecast due to stronger US outlook and an increase in fuels for shipping as ships take longer routes due to the tension in the key shipping route through the Red Sea.

- Regulating AI: The European Union Parliament passed an act to regulate artificial intelligence, making it the first in the world to create regulation on AI. There was not much detail on how it regulates AI, but one source said it would categorize AI technologies into risk levels, some of which would be banned if considered “unacceptable.”

Did You Know…?

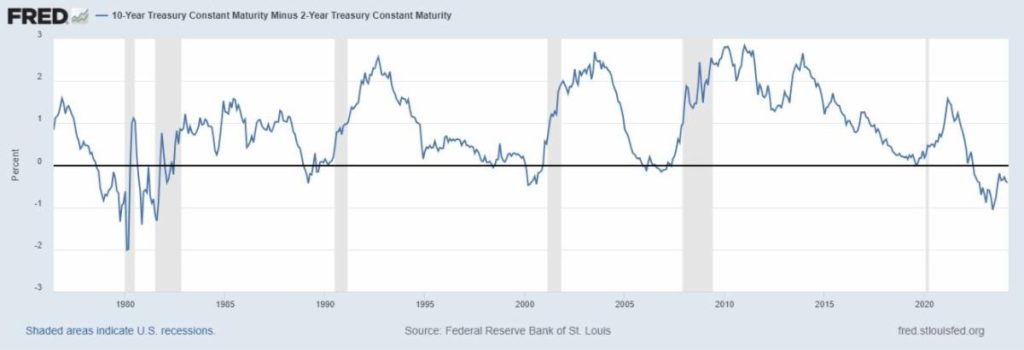

Record Long Yield Curve Inversion

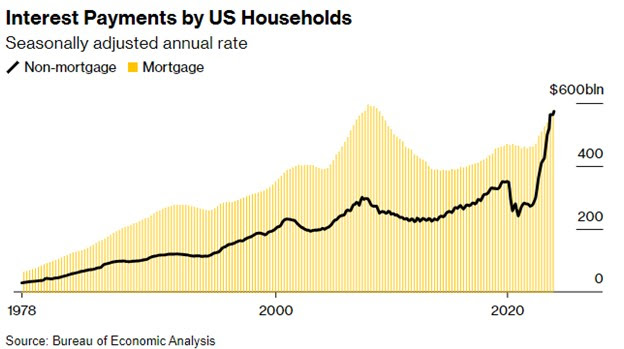

Non-Housing Interest Payments

WFG News

The Week Ahead

The focus this week will be on the Fed and Nvidia/AI. The Fed’s policymaking committee, the FOMC, meets this week with a policy announcement on Wednesday at 2:00pm followed by a press conference with Chairman Powell. Also with this meeting is the release of updated Summary of Economic Projections. This is where all Fed official make short term and long term projections on things such as economic growth, inflation, unemployment, and interest rates. Nvidia and AI is the other big event with Nvidia holding its annual GTC conference where investors will look for updates on everything AI. The economic calendar shifts to the housing market with updates from the housing market index, housing starts and permits, and existing home sales. Other data releases include jobless claims and the Philly Fed manufacturing survey on Thursday. Earnings wind down but there will be focus on several high profile earnings like Micron on Wednesday and Nike, Lululemon, and FedEx on Thursday.