Wentz Weekly Insights

GDP Growth Much Stronger Than Expected

On the corporate side, it will be another busy week of earnings. The highlight of the week will be Apple’s earnings results Thursday after the market close. Expectations have diminished going into the report after recent reports that iPhone 15 demand was weak.

Week in Review:

Recent Economic Data

- Sales of new homes in September surprisingly rose 12.3% to a seasonally adjusted annualized rate of 759,000, well above the expectations of 680,000. Sales are up 33.9% from a year earlier. New home sales are based on signed contracts so this reflects people that were out shopping for homes in September, which comes at more of a surprise because that’s when rates spiked. Reports say builders are buying down mortgage rates aggressively though, which may be contributing to the improving sales pace. Inventory of new homes was 435,000, which has been relatively unchanged all year, and represents a supply of 6.9 months at the current sales pace, with homebuilders said to be continuing to work through backlogs. In addition, a higher share of new home buyers is coming from all-cash buyers.

- New orders for manufactured durable goods for September increased 4.7%, well above the expectations of a 1.0% increase. However, new orders of transportation equipment rose 12.7%, including a 92.5% increase in aircraft, skewing the index to the upside. Excluding transportation, durable goods orders were up 0.5%, still strong and still over double the expectation. Meanwhile, the input to GDP, shipments of nondefense core capital goods excluding transportation, was flat in the month. These shipments rose at an annualized pace of 1.3% in the third quarter, a positive for GDP as mentioned below.

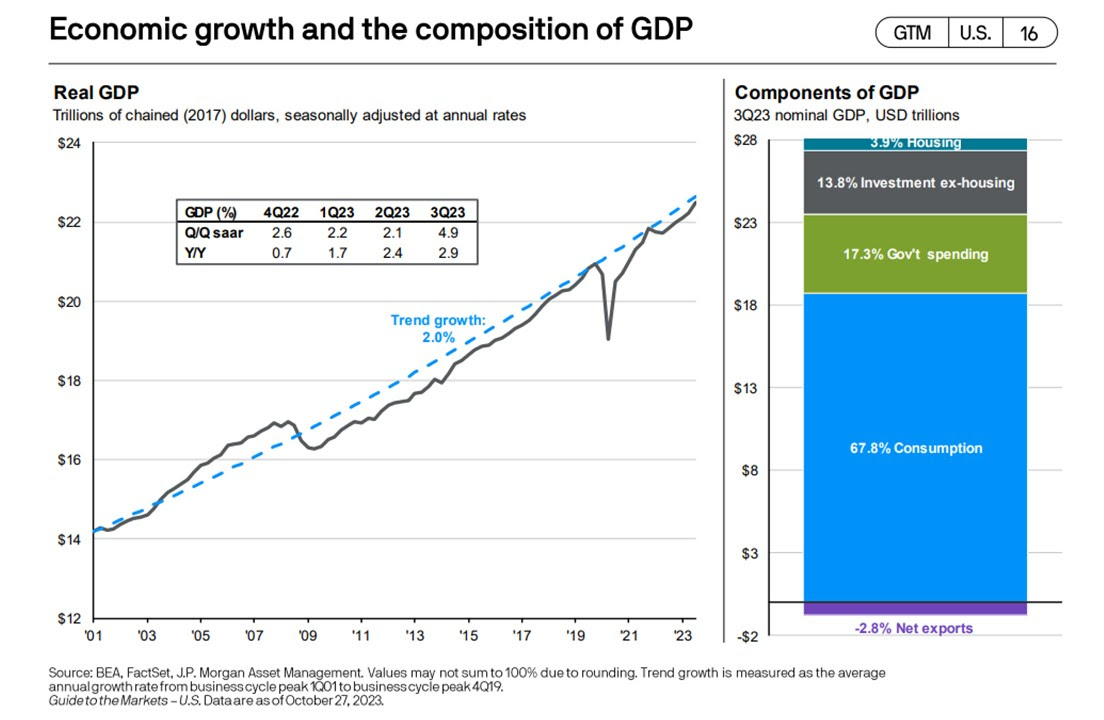

- Growth in the US economy, based on the initial GDP estimate, during the third quarter was at an annualized rate of 4.9%, and excluding the pandemic bounce was the fastest growth rate since 2014. Once again consumer spending saw strength with other major categories contributing. Consumer spending rose at an annual rate of 4.0% in the quarter with a 4.8% increase in spending on goods and a 3.6% increase in spending on services. The strong consumer spending contributed 2.7% to the headline 4.9% GDP number. Business fixed investment grew 0.8%, driven by a 2.6% increase in intellectual property, while residential investment grew 3.9%. Business investment had no contribution to GDP while residential contributed 0.2%. Businesses were busy restocking as investment in inventory contributed 1.3% to GDP. Government spending grew 4.6%, driven mostly by defense spending, and contributed 0.8% to GDP. Finally, the change in the trade deficit was a 0.1% contractor to GDP due to imports increasing 5.7% and exports increasing 6.2% (the dollar amount is what matters, and imports were still larger than exports). One of the better measures of core economic growth, final sales to domestic purchasers, grew a still very solid 3.5%, driven by strength in consumer spending.

- The number of unemployment claims filed the week ended October 21 was 210,000, up 10k from the prior week, although still very low levels. The four-week average increased slightly to 207,500. The number of continuing claims was 1.790 million, up 63k from the prior week, bringing the four-week average up 31k to 1.723 million.

- Consumer spending remained strong in September, according to the latest personal income and outlays report released on Friday.

- First, personal income increased 0.3% in the month, slightly lower than the 0.4% expected and matching the increase seen in August. The all important wages and salaries category rose 0.4%, slightly lower than the 0.5% increase in the prior month. Incomes are up 4.9% from a year earlier, cooling from the 5.1% pace in August.

- Consumer spending surprised again to the upside, rising a healthy 0.7% in September, above the 0.5% estimates and accelerating from the 0.4% increase in August. Spending was driven by both goods and services, with goods spending up 0.7% and services spending up 0.8%. Goods spending is now up 4.6% over the past year while services spending is up 7.9%. With these numbers, it is likely we see an upward revision to GDP next month in the second estimate.

- Consumers are spending 44% more in interest costs compared to 12 months ago, which was 2.7% of disposable income, up from 2.0% of disposable income a year ago, which is expected to continue to increase and will cut into discretionary spending.

- The PCE price index, the Fed’s preferred inflation reading, rose 0.4%, slightly stronger than the 0.3% expected. The index is up 3.4% from a year ago, cooling further from the 3.5% rate in August. Core prices rose 0.3% as expected and are up 3.7% from a year ago, cooling from the 3.9% pace in August.

- Personal savings fell 15% in the month, resulting in the personal savings rate falling to the lowest level of the year at 3.4%, after a steady increase to a two-year high of 5.4% in May.

- Money supply saw another decline in September, now down for the second consecutive month, coming after three straight months of increases, which was after nine consecutive months of declines. Money supply of $20.755 trillion was down $70.4 billion in the month for a 0.3% decline, and down 3.6% from a year ago. Money supply is still up a staggering $5.304 trillion, or 34%, since the pandemic started, one of the most obvious reasons we have had persistent inflation. The good news is money supply is down 4.4% since the peak on February 2022, which will help cool inflation. The bad news is a decline typically leads to lower economic growth.

Company News

- Reuters reported Nvidia has quietly begun designing CPUs (central processing units – the main chip/brains of computers) that would be able to run Microsoft’s Windows operating system and will use technology from Arm Holdings. Intel, which currently still dominates the CPU market, shares were down on the news, while AMD, who has been taking large market share over the past several years, and Nvidia shares were higher. The report says the plan is part of Microsoft’s effort to help chip companies build Arm-based CPUs for Windows built PCs. Qualcomm currently makes Arm-based chips, and AMD is said to have joined as well. It says the efforts are aimed to counter Apple’s plan on building its own in-house chips for its Mac computers.

- Facebook’s parent company Meta is being sued by a bipartisan group of 42 attorney generals who say features on Facebook and Instagram are targeted at young users which make the platforms addictive and keeps users on for longer and repeatedly coming back, causing harm to the mental health of young people. The attorney generals said Meta does this by the design of its algorithms, frequent alerts, notifications, and its infinite scroll through feeds.

- Early last week, the United Auto Workers (UAW) said 6,800 Stellantis workers at the Sterling Heights assembly plant walked of the job to join the ongoing UAW strike. This is the company’s largest US plant and is known for producing the profitable Ram 1500 model. Separately, hours after General Motors reported its third quarter earnings, the UAW said it expanded its strike to the GM Arlington plant where it builds all of their full size SUVs and is its most profitable plant. GM now has 42% of its production shut down from the ongoing UAW strikes.

- Late in the week, Ford said it had reached a tentative contract agreement with the UAW, which brings the nearly two-month long strike to an end. Over the weekend, it was announced Stellantis, then GM, reached tentative agreements with the union as well. Among many other benefits, the agreement includes a 25% hourly pay raise, plus cost of living adjustments, over the new four year contract.

Other News

- China said it will issue 1 trillion yuan (about $140 billion) in new sovereign bonds, which will put its budget deficit ratio at about 3.8% from 3.0%, in another effort to provide stimulus to its economy over slowing growth worries. The government is targeting infrastructure, where it said would benefit industries that it believes will replace those that used to drive the economic growth, like its property sector. Separately, one of its largest property developers, Country Garden, officially defaulted on its dollar bond, sending a notice to bondholders that its failure to pay interest on the bonds within its grace period “constitutes an event of default.”

- The European Central Bank kept its policy rates unchanged after its latest policy meeting last week, the first unchanged meeting after 10 consecutive rate increases. Policymakers agreed to start discussing early next year the possibility of ending its Pandemic Emergency Purchase Program early, which started during the pandemic to maintain functioning of the bond market. Some policymakers have made the case the program is working against the central bank’s efforts to tighten monetary policy in order to bring inflation lower. The opposing argument is the program is needed for weaker Eurozone economies like Italy because it protects them from undue market volatility.

- The Bank of Canada said in its latest policy meeting last week it would keep its policy rates unchanged as well, adding that it is seeing growing evidence that past rate increases are beginning to work on “dampening economic activity and relieving price pressures.” It added that consumption has been “subdued” and housing and durable goods have seen softer demand. However, it said it is concerned that progress toward bringing inflation to target has slowed and risks of inflation reaccelerating have increased.

- Late last week the House elected Mike Johnson, Representative from Louisiana, as Speaker of the House in a 220-209 vote. The big question now will be if Congress can pass a continuing resolution beyond the November 17 deadline which would give Congress more time before a more crucial deadline.

WFG News

Medicare Open Enrollment

- During this period, individuals are able to make changes to their current Medicare coverage. Individuals on Medicare should receive an Annual Notice of Change and/or Evidence of Coverage for Medicare Advantage or Part D plan. This is a good time to review coverage, as medical needs, benefits, and premiums may have changed over the year. During this time here are some things to consider:

- Will your primary doctor still accept you Medicare Advantage Plan?

- Have your medical needs changed? Different plans offer different benefits and different costs

- Are there comparable, lower cost plans available? Don’t forget to consider out-of-pocket costs when comparing options

- Are you medications still on your plan’s list of covered medications?

Office Update

Toys for Tots Toy Drive

Career Development Day

The Week Ahead

Many labor market indicators will be released this week including the job openings and labor turnover survey, ADP employment report, and the Department of Labor employment report for October. The consensus of economists sees about 185,000 new jobs added in the month, a slowdown from the first half of the year but still signaling strong labor market growth. Elsewhere on the economic calendar, on Tuesday we will see the employment cost index for the third quarter, the consumer confidence reading for October, and a reading on home prices with the Case-Shiller home price index which is expected to show another 0.7% increase in home prices in September. Wednesday will see manufacturing readings with the PMI and ISM manufacturing indexes, and data on September construction spending. On Thursday the first read on third quarter productivity and labor costs is released along with October vehicles sales. The main economic event will be the employment report on Friday. On the earnings front, another 30% of the S&P 500 is expected to report quarterly financial results. Earnings estimates have come down in recent days, and this week will include key reports from companies such as McDonald’s, Pinterest, SoFi on Monday, AMD, Busch, Caterpillar, Pfizer on Tuesday, Airbnb, CVS, Kraft, PayPal, Qualcomm on Wednesday, Moderna, DraftKings, Starbucks on Thursday, and Dominion on Friday. But all eyes will be on Apple’s results on Thursday afternoon. Finally, the main event for investors will be the Federal Reserve FOMC meeting that ends on Wednesday with a policy announcement at 2:00. No change in rates are expected, but market participants may, after recent stronger data, may be looking for hawkish commentary after the recent stronger economic data.