Wentz Weekly Insights

Stocks & Bonds Lower With Hard Economic Data Painting A Different Picture Than Anecdotal Evidence

Week in Review:

Recent Economic Data

- Retail sales, once again, surprise to the upside. Sales in September rose 0.7%, over double the 0.3% increase estimated and the best monthly increase since January’s 2.8% increase. Of course, oil prices were higher which pushed up gasoline sales 0.9%, however it was not all due to gas. Retail sales excluding gasoline sales and vehicles was still 0.6% higher. Even more, the “control group” which looks at more core, less volatile spending categories, was up 0.6% as well. Ten of the 13 major categories saw an increase in the month led by a 3.0% increase in miscellaneous store, 1.1% in e-commerce, 0.9% in bars/restaurants, and offset somewhat by a 0.8% decline in electronics, 0.8% decline in apparel, and 0.2% decline in building materials/gardening. Through the first nine months of the year retail sales are up 3.1% with core sales that exclude vehicles and gasoline up 5.0%. In addition, the increase in retail sales was revised higher for August across the board.

- The housing market index, a measure of homebuilder sentiment, fell for the third consecutive month to the lowest level since April. The index was 45 in October, down 5 points from 50 in September (an index of 50 is considered breakeven, below 50 indicates contracting/weak activity and above 50 indicates growing/stronger conditions). The present sales index fell into contraction territory after falling 4 points to 46, expectations on sales over the next six months fell 5 points to 44, while homebuyer traffic fell 4 points to a very depressed level of 26, just off the all-time low earlier this year of 20.

- In September the number of housing starts rose 7% to a seasonally adjusted annualized rate of 1.358 million, but still outside last month was one of the lowest levels of the post-pandemic recovery. Starts are down 7.2% from a year earlier. The number of permits for new builds fell 4.4% to an annualized rate of 1.473 million, and down 7.2% from a year ago.

- Sales of existing homes in September fell to the slowest pace since October 2010. In September there was, on a seasonally adjusted annualized rate, 3.960 million existing homes sold, a 2.0% decline from August and down 15.4% from a year ago. In fact, existing home sales are down 37% from the 6.300 million pace set two years ago. After a brief bounce in home sales earlier this year, recent data confirms the housing market is back in a decline and remains in a recession. For comparison purposes, the all-time peak in 2005 was 7.250 million and the low after the Great Recession was 3.450 million. A higher percentage of home sales are now coming from the high end of the market, that because those buyers can afford to buy with cash, versus low end buyers that typically finance, and with higher interest rates are still experiencing sticker shock of higher rates. In addition, 29% of sales came from cash buyers, up from 22% last year. Limited inventory is a huge issue due to potential sellers not wanting to give up their current rates, with just 1.13 million homes on the market, marking just 3.4 months supply. At the same time, the median price has increased for the third consecutive month, driven by low supply.

- The number of unemployment claims filed for the week ended October 14 fell to one of the lowest levels of the year, dropping 13k from the prior week to 198,000 and the first time below 200k since January. The four-week average fell 1k to 205,750. The number of continuing claims increased 29k to 1.734 million with the four week average increasing 19k to 1.694 million.

- The Empire State Manufacturing survey index was -4.6 for October, suggesting manufacturing activity went back to declining in the first two weeks of the month. This comes after a small increase in September, based on the index of 1.9. New orders fell slightly, shipments were little changed, and delivery times shortened, while labor market indicators suggested an increase in employment and the average workweek. Selling price increases moderated while the pace of input price increases was similar to September. The index for future conditions was down three points to 23.1, but still suggest firms remain optimistic.

- The Philly Fed manufacturing index remained in negative territory, at -9 for October compared to the -13.5 from September. While the general activity index suggest declining activity still, new orders and shipments moved into positive territory, suggesting very small growth in those categories. Meanwhile, employment turned positive while the price index continues to show overall price increases.

- Industrial production increased 0.3%, slightly better than expected and consistent with the recent trend of strengthening conditions. Better industrial production was driven by a 0.4% increase in manufacturing, 0.4% increase in mining, offset by a 0.3% decline in utilities. Capacity utilization was 79.7%, the same as last month.

- The average 30-year mortgage rate (for first-lien prime conventional mortgages with a loan-to-value of 80%) rose another six basis points last week and now stands at 7.63%, a new 23-year high, according to Freddie Mac. The average rate is now up 1.21% from where it started the year. Separately, Mortgage News Daily reported the average 30-year rate hit 8.0%, also the highest since 2000.

Company News

- Rite Aid announced in a statement that it has filed for Chapter 11 bankruptcy protection. In August, the WSJ reported the company was planning to file for bankruptcy to restructure over $3 billion in debt, some of which stemmed from the liabilities related to the opioid-related lawsuits. Rite Aid now joins at least three other companies, Purdue Pharma, Endo, and Mallinckrodt, which all had to file bankruptcy due to costs from the opioid litigations. Rite Aid has already received commitment for refinancing from certain lenders.

- In an annual memo to its employees, Snapchat parent company Snap’s CEO Evan Spiegel laid out the company’s 2024 goals. They included 475 million daily active users, growing content and time spent per viewer, 20% increase in ad revenues, 14 million Snapchat+ subscribers, and $500 million of adjusted EBITDA. Shares rose 12% on the day the memo was reported.

- After the announcement of a new US export ban that would restrict exports of advanced chips to China, Nvidia redesigned its advanced AI chips specifically for the Chinese market. However, according to CNBC, the US announced these redesigned chips will be included in new and tightened export restrictions and the US will block the sale of these new chips to China. Nvidia shares fell about 5% after the news. The report says it could impact sales of chips produced by Intel and AMD as well. Nvidia later said the new restrictions are not expected to have a meaningful near-term impact on financial results.

- In conjunction with its earnings report, which beat estimates and included 8.76 new subscribers that was better than the 6.2 million forecasted, Netflix said it will be moving forward with price increases in the US and UK. The service with advertisements will remain $6.99 per month while the basic plan will increase to $11.99/month and premium up to $22.99/month.

- In M&A activity, early Monday morning Chevron said it has agreed to acquire Hess Corp in a $53 billion deal. It will be an all-stock transaction where Chevron will issue about 317 million shares of common stock and where Hess shareholders will receive 1.025 shares of Chevron for each share of Hess they own. The deal represents a 4.9% premium to where Hess shares were trading as of the previous day’s closing price. Chevron said the acquisition will enhance its portfolio, grow its production, and will double its free cash flow by 2027.

Other News

- The Federal Reserve released its Beige Book, which is a report that summarizes economic conditions across all 12 Federal Reserve districts based on anecdotal information collected from businesses contacts, consumers, economists, and market experts. To summarize, the Book stated districts saw little or no change in economic activity, a much more bleak assessment than what recent economic data has indicated. It said there was mixed activity on consumer spending, slowing in consumer travel, but increases in business travel, slight to modest declines in loan demand, an easing in the labor market with less pushback from workers on wage increases, and input costs that are still rising at a faster than average pace for the services sector. The outlook for the economy was generally stable or slightly weaker growth.

- The US announced it removed certain sanctions on Venezuela that would allow the country to export crude oil without restrictions for the next six months. The agreement included Venezuela’s commitment on political reform including a commitment that it will hold democratic elections. Bloomberg notes the easing of restrictions would allow Venezuela to increase production by 200k barrels/day. Prior to the new sanctions several years ago, Venezuela was producing about 2.4 million bbl/day.

- The main event on the Federal Reserve calendar was Jerome Powell’s appearance at the Economic Club of New York in which he stated it has been “historically unusual” that declining inflation has not come at the cost of higher unemployment. He added that growth has consistently surprised to the upside this year, as seen in retail sales earlier in the week and a return of inflation to target will take a period of below-trend growth and softening in labor market conditions. He mentioned there is still “meaningful tightening” in the pipeline from rate increases that still have not been felt in the economy and will take time to be felt and that is why the Fed is comfortable taking it slower. A slightly more hawkish comment, he added that “additional evidence of above-trend growth” (as we are seeing now) could warrant more rate increases. From our view there was not much new that he revealed that we did not already know, but markets took it as slightly more hawkish, particularly when compared to other Fed policy makers’ remarks recently. At the end of the day stronger economic data equals more rate increases.

Did You Know…?

Auto Loan Trouble Brewing:

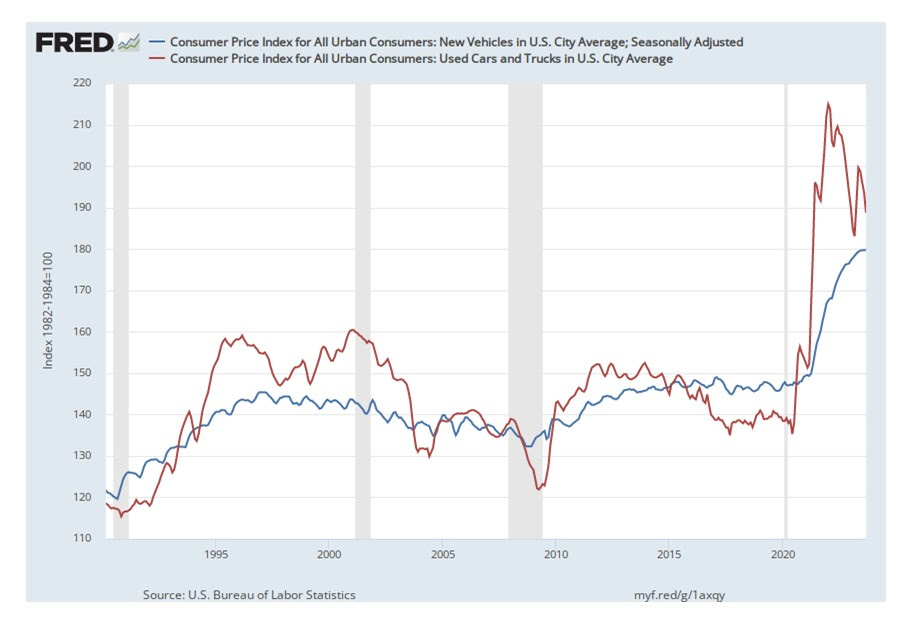

New data shows that Americans are falling behind on auto loan payments at the highest rate since data began over 30 years ago. According to Fitch Ratings and reported by Bloomberg, the percent of subprime borrowers with required payments at least 60 days past due rose to 6.10% in the latest month. This is the highest since data began in 1994. There could be several factors contributing to the higher percentage. First, rates are much higher than they were one or two years ago, or even where rates were prior to the pandemic. According to Bankrate, the average interest rate for those with the best credit score is about 5.07% for a new vehicle and 7.09% for a used vehicle, and for the worst credit scores, is 14.18% and 21.38%, respectively. The other reason is vehicles are much more expensive now and during the pandemic rose at the fastest pace on record. While vehicle prices were lower in September versus a year earlier, they are still 36% higher on average than prior to the pandemic, and at the peak in the beginning of 2022 were 55% higher on average. New vehicles have seen large price increases as well. New vehicles are about 3% higher from a year ago and 22% higher than pracademic levels. Over the prior decade, new car prices average a 0.8% annual increase and used car prices averaged a 1.0% annual increase. The chart below shows how new car prices (blue) and used car prices (red) have changed since the early 1990s.

WFG News

Medicare Open Enrollment

- Medicare Open Enrollment period runs from October 15 to December 7 each year

- During this period, individuals are able to make changes to their current Medicare coverage. Individuals on Medicare should receive an Annual Notice of Change and/or Evidence of Coverage for Medicare Advantage or Part D plan. This is a good time to review coverage, as medical needs, benefits, and premiums may have changed over the year. During this time here are some things to consider:

- Will your primary doctor still accept you Medicare Advantage Plan?

- Have your medical needs changed? Different plans offer different benefits and different costs

- Are there comparable, lower cost plans available? Don’t forget to consider out-of-pocket costs when comparing options

- Are you medications still on your plan’s list of covered medications?

The Week Ahead

This week starts the busiest stretch of third quarter earnings season with over 30% of the S&P 500 set to report third quarter results this week. Earnings are estimated to have seen a slight increase compared to a year ago. There will be a bigger focus on some of the larger tech companies due to their significant outperformance this year with Microsoft and Alphabet reporting on Tuesday, Meta on Wednesday, and Amazon on Thursday. Other notable results include GE, General Motors, Visa, Coca-Cola, Texas Instruments on Tuesday; Boeing, General Dynamics, T-Mobile on Wednesday; Mastercard, Intel, Altria, Chipotle, UPS on Thursday; and Exxon Mobil, Chevron, and AbbVie on Friday. The economic calendar shifts from a focus on the housing market to economic growth and the consumer later this week. September new home sales is released Wednesday. This is followed by durable goods orders, jobless claims, and the first estimate on third quarter GDP on Thursday morning. Economists are estimating GDP grew at an annualized pace of 4.2% in the quarter, while the Atlanta Fed’s GDPNow model is forecasting a 5.4% growth rate. On Friday we will see the consumer sentiment survey along with the BEA personal income and outlays report on incomes, spending, and inflation for September. The Federal Reserve goes into a blackout period beginning this week ahead of the next FOMC meeting on October 31-November 1. In other Central Bank news, the European Central Bank meets this week with a policy decision coming Thursday, where it is expected to hold rates steady. Politics/Geopolitics will continue to be in the headline with the conflict in Israel/Gaza and the House still without a Speaker and getting closer to the funding deadline.