Wentz Weekly Insights

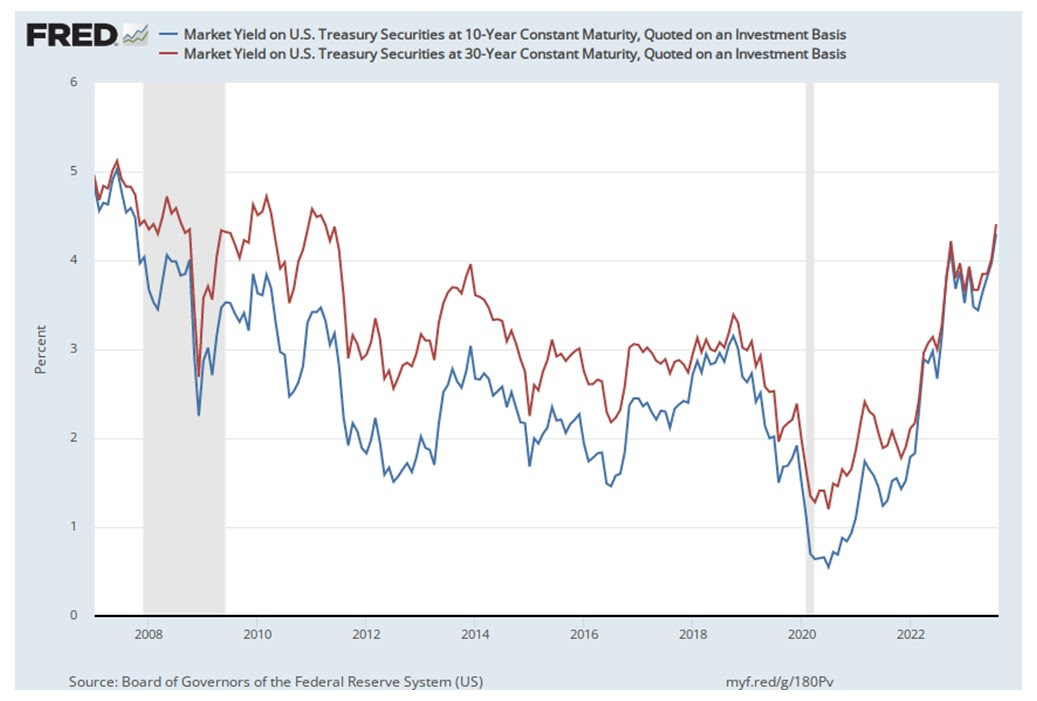

Treasury Bond Yields Highest in 15 Years As Markets Reprice Future Interest Rate Expectations

|

|

Recent Economic Data

- Retail sales in July rose 0.7%, nearly double what was expected, to a seasonally adjusted $696.4 billion with 9 of the 13 major categories rising in the month. Excluding gas and vehicle sales, which are two categories that tend to be volatile, sales rose a stronger 1.0%. Driving sales higher in the month was online sales rising 1.9%, sporting goods stores up 1.5%, restaurants & bars up 1.4%, and general merchandise stores up 0.8%. This was offset by a 1.8% decline in furniture store sales, 1.3% decline in electronics and appliances, and a 0.3% decline in vehicle sales. Sales are up 3.2% from a year ago with the strongest sales growth in restaurants & bars and online sales, offset by large decline in gas sales (lower gas prices), furniture, electronics & appliances, and building materials. The annual change is still positive, but subtracting the 3.2% inflation over the same period sales are flat. In addition, the better than expected increase could be due to Amazon’s Prime Day driving growth. Still overall a strong report proving the consumer remains strong.

- The housing market index, a survey measuring homebuilder sentiment, was 50 for August – right at a level that is breakeven (above 50 is positive). This is down from 56 in July and corresponds with the move higher in interest rates over the past month. Basically all components deteriorated in the month – the present situation index fell 5 points to 57, the expectations over the next six months fell 4 points to 55, while the traffic of potential buyers fell 6 points, remaining at depressed levels at 34 in August.

- July housing starts and permits were basically exactly in line with expectations, rising slightly from June’s levels. The number of housing starts rose 3.9% in July to a seasonally adjusted annualized pace of 1.452 million and up roughly the same amount from July 2022. The number of permits to build a new home were relatively unchanged in July at an annual rate of 1.442 million, which is still 13% below the rate from a year ago. The number of homes under construction remains pretty strong at the highest level in 50 years at 1.681 million (annual rate), relatively unchanged from last year, while the number of homes authorized but not yet started construction fell to the lowest since the beginning of 2022 at 277k. There is still a lot of demand for new homes as there is limited existing supply, but there may be early signs future construction is possibly slowing.

- General manufacturing activity fell again in August with the Empire State Manufacturing survey index at -19.0 for the month, a sharp drop from -0.4 in July. New orders and shipments fell “significantly” while delivery times were steady. Employment conditions were steady but the average work week was shorter and input and selling prices increased in the month. If there is any positive it was that firms became more optimistic with the future business conditions index up to 19.9 for the highest level in over a year.

- On the other hand, manufacturing activity in the Philadelphia region improved in August, according to the Philly Fed manufacturing survey. The survey’s index was 12, up from a -13.5 in July, suggesting growing conditions for the first time in 12 months. About 25% of firms reported growing conditions, 12% reported a decrease and 58% reported no change. New orders rose 32 points to 16, the first positive signal in 14 months, while shipments rose positive as well. However, employment showed a decline while price increases were near their long-term average.

- Industrial production rose 1.0% for the second best increase this year, the best since January, which comes after a 0.8% decline in June. The strong increase was broad based but due mostly to a sharp bounce back in utilities of 5.4% due to weather with higher than average temperatures in the South and Southwest (after a 3.0% decline in June), as well as a 0.5% increase in manufacturing, driven by auto production, and 0.5% increase in mining, driven by oil and gas production. Utilization rate was 79.3%, which was a half point increase in July but has been lighter than average over the past year or so.

- After declining 10 of the past 12 months, prices of goods and services imported to the U.S. saw a 0.4% increase in July, the largest monthly increase since the beginning of 2022. Contributing to the increase was a 3.6% increase in fuel prices and prices excluding fuel were unchanged in the month. Import prices are down 4.4% over the past 12 months, after bottoming in June at -6.1%. Prices of U.S. exports increased 0.7% in July, also coming after declining 10 of the past 12 months. The increase was led by prices of agricultural good rising 0.9%, but prices excluding agricultural exports were still up 0.6%. Over the past 12 months, export prices are still down 7.9%, although improving from the 12 month decline of 11.9% in June.

- Initial unemployment claims for the week ended August 12 decreased 11k from the prior week to 239,000 back to levels it was at over the past two months (after a spike the week prior). The four-week average rose 3k to 234k. The number of continuing claims was 1.716 million, up 32k from the prior week with the four-week average at 1.693 million (down 8k).

- The 30-year mortgage rate for the prime borrower rose to a new 20-year high, surpassing the highs from November. The average rate was 7.09% after a 13 basis point increase last week, following treasury yields higher, and the highest since April 2002. A year ago at this time, the prime 30-year rate was 5.13%.

Company News

- One day after Cleveland Cliffs made public its offer to acquire US Steel, Esmark Inc., a privately held company with a portfolio of industrial companies, said it offered to buy US Steel for $35/share in cash (slightly higher than Cliffs’ cash and stock offer). The Steelworkers union said it supports the Cliffs deal due to the synergies it provides and as the best way to preserve union jobs. Later in the week, reports surfaced that Luxembourg based and the second largest steel company in the world, ArcelorMittal, is working with investment bankers on a potential offer. On Friday, Cliffs said it received exclusive assignment of the right to bid for US Steel from the steelworkers union. Under the labor contract between the union and US Steel, the union has the right to bid for the assets but not block a potential deal and the assignment transfers the unions’ rights to Cliffs, making Cliffs the only realistic buyer of US Steel.

- The Financial Times reported the Saudis and UAE have bought “thousands” of GPUs (graphic processing units), including from Nvidia, to build out AI software (GPUs are the most important component in creating AI related software). The report added UAE is building its own large language model known as Falcon. Nvidia shares rose 7% after the news along with analyst upgrades.

- Last week Johnson & Johnson said the exchange ratio would be 8.0324 shares of Kenvue common stock for each share of Johnson & Johnson owned. In a previously announced split off, JNJ said it will offer current shareholders the opportunity to exchange their shares of JNJ for shares of its split off consumer brands business Kenvue – which owns brands such as Band-Aid, Tylenol, Listerine, Nicorette, and Neosporin. The exchange ratio represents a 7% premium, based on a previous news release by JNJ. The exchange offer expired August 18 and JNJ said it was oversubscribed, as a result those that offered to exchange will receive shares on a prorated basis, excluding those that own 100 or less shares or odd lots.

- Blue Shield of California, a non-profit health insurer, said yesterday that as part of its new pharmacy care model it will use a number of pharmacy service providers beginning in 2024, as opposed to using just CVS as its pharmacy benefit manager (PBM). Shares of CVS were down 8.1% after the news. CVS later said the financial impacts of the partial termination of Blue Shield of California’s contract is not expected to have an impact to CVS’ guidance and is expected to have an immaterial impact on its longer-term outlook. It reaffirmed its 2023 guidance with EPS of $8.60.

- Target and Walmart reported quarterly results last week that showed a similar trend in consumer spending. Both reported mixed results compared to expectations and both saw lower mark downs, lower costs, and price increases which helped profits while Walmart benefited from a more price conscious consumer. In addition, both saw a greater shift in spending to necessities like food, health and essentials and a decline in general merchandise and discretionary categories.

Other News

- The Fed’s FOMC meeting minutes from its July 26 meeting were mostly as expected with almost all policymakers favoring a rate hike – although it was a unanimous decision, two supported holding rates unchanged. Most officials continue to see “significant” upside risks to inflation which could bring on more rate increases. Meanwhile, some officials said policy is in restrictive territory and as such the risks are now two sided, this compares with recent meetings where Powell described the risks was still doing too little versus too much. When it comes to future decisions, policymakers will rely heavily on incoming data, similar comments to what Powell relayed in his press conference.

- There might be another large union strike in the works – the United Auto Workers union is going to vote this week to authorize a strike against automakers as discussion between union leaders and the automakers about wages and other economic issues are moving too slow. CNBC reported that the work stoppage by union members would result in an economic loss of more than $5 billion after 10 days, according to Anderson Economic Group.

- A risk of trade tensions are rising between the US and Mexico. Bloomberg reported last week that the US is preparing to accelerate its complaint that Mexico violates the free trade deal with its ban on genetically modified corn. The US Trade Representative is preparing to form a dispute resolution panel under the trade agreement with the purpose of finding if Mexico’s ban is inconsistent with the trade agreement. The report says if the panel sides with the US, it could result in tariffs on Mexican goods (Mexico is now the largest US trade partner).

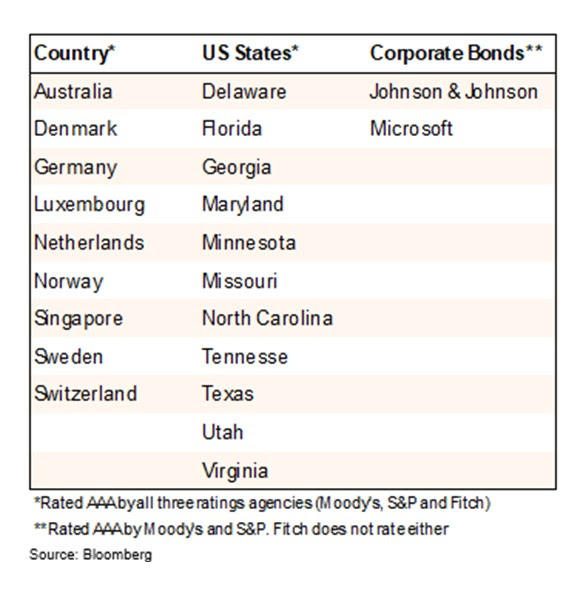

- Fitch Ratings warned that credit ratings at dozens of US banks, including some of the largest banks, were at risk. This comes days after Moody’s cut a handful of small/mid-sized banks credit ratings. Fitch said it could downgrade the banking industry score to A+, down from AA- and this would force it to downgrade some of the highest rated banks due to the policy no individual bank can have a higher rating than the environment in which it operates. If it is forced to cut the rating of a bank like JPMorgan, who has the top rating of all banks, then it would be forced to consider a cut for all its peers. What would cause it to downgrade the industry would be the path of interest rates and if loan defaults continue to rise above a “normal level of losses.”

Did You Know…?

The AAA Rating Club:

WFG News & Events:

The Election & Its Impact on The Markets:

Wentz Financial Group is happy to announce we will be brining back guest speaker Phil Orlando for a discussion on his and Federated’s thoughts on the current market and economic environment. Phil will expand on the election of 2024 and its implications for markets. Phil Orlando is Chief Equity Market Strategist of Federated Investors with over 43 years of experience and is responsible for formulating Federated’s views on the economy, markets, and the firm’s investment positioning strategies. RSVP early as this event will reach capacity quickly!

The Week Ahead

As earnings season dies down, the coming week includes several important events that could determine the path of markets in the weeks ahead. Nvidia, the graphic chip maker, among other chips, who reported a blowout quarter in May that sparked the AI rally, reports its quarterly results on Wednesday and the stock is expected to see a big move (in either direction) after and could show the AI rally has room to run or that the hype is nearly over. On Friday the main event for the week will be the Federal Reserve Bank of Kansas City hosting the Jackson Hole Economic Policy symposium from Thursday to Saturday. The key event will be Chairman Jerome Powell’s speech on Friday. The event is known in the past to be where Fed policymakers announce key changes to monetary policy. The topic this year is “Structural Shifts in the Global Economy.” Elsewhere, on the economic calendar we will see existing home sales on Tuesday, where sales for July are expected to be flat, new home sales on Wednesday, durable goods orders and jobless claims on Thursday, and the consumer sentiment survey results on Friday. Although second quarter earnings seasons is nearly over, there are still several notable companies reporting this week including Zoom Video on Monday; Lowe’s, Macy’s, Toll Brothers, Dick’s Sporting Goods on Tuesday; Nvidia, Snowflake, Autodesk, Foot Locker on Wednesday; and Ulta Beauty, Affirm, Gap, Intuit, Workday, and Marvell on Friday.