Wentz Weekly Insights

Volatility Up, Stocks Down, Earnings Ahead

The S&P 500 was lower every day last week, now on a six day losing streak, falling 3.05% for the week. The index fell below its 50 day moving average for the first time since November, the longest streak in over 30 years, illustrating just how strong markets have been over the past six months. Volatility has spiked amid an increase in geopolitical tensions, repricing of Fed rate cuts, rising bond yields, and uncertainty around earnings. The volatility index (or VIX) rose as much as 23% last week to its highest level since October when the market saw its last drawdown.

At the same time the repricing of Fed rate cut expectations has put upward pressure on bond yields sending bond prices lower and deeper into negative territory for the year. The 2-year Treasury yield rose another 9 basis points to 5.00% and the 10-year yields rose 10 bps to 4.63%. These are both at the highest since October, the same time the market saw its last pullback. In fact, Treasury yields have only been this high for one month since the mid-2000s, which was October last year.

Market participants’ focus last week has been on recent Fed comments and repricing of fed rate cut expectations, geopolitical tensions in the Middle East and Israel’s response, and earnings results which have been very mixed so far (banks mixed, transportation weak, airlines strong).

Stocks initially got off to a very rough start overnight Thursday and into Friday’s trading after reports of Israel’s response to the Iranian drone strikes. However, the response was more muted than feared, preventing a counterattack from Iran and preventing a broader selloff and a further spike in energy prices (due to the Middle East, and Iran, being a major oil producing region).

The past several weeks have seen a large amount of comments from Federal Reserve policymakers and the overall consensus is to expect less rate cuts this year than thought just several weeks ago and expect those rate cuts, including the first, to be push further down the road. There is wider agreement that the progress on bringing inflation lower has stalled, evident after three consecutive monthly inflation reports showed higher inflation than expected.

Chairman Powell made notable comments on Tuesday at a discussion with the Bank of Canada. For the first time he said the recent data has shown a “lack of further progress” on inflation this year. He added that the data has failed to give him greater confidence that inflation is on a continued trend of moving lower and it is likely to take longer to achieve that confidence, suggesting it will be longer than anticipated to implement the first cut in interest rates. Recall from the most recent FOMC meetings that Powell said the Fed needs to see greater confidence inflation is continuing to move lower, which he suggested would come from several more months of data showing inflation is coming down.

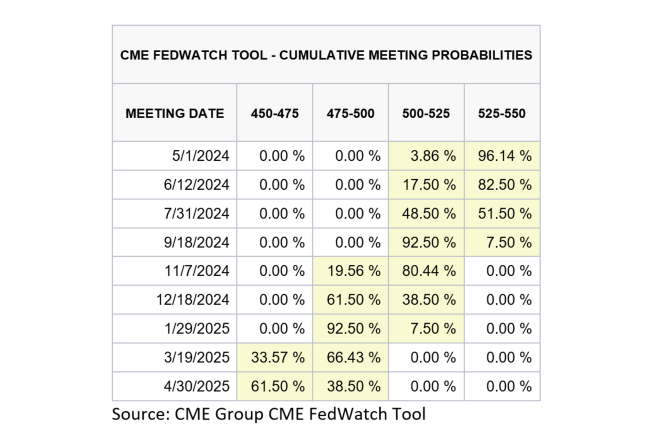

The result has been a reprice in market pricing on future interest rates. At the beginning of the year, markets were pricing in two rate cuts by the Fed’s May meeting (taking place next week) and the pricing was showing the greatest odds were on six rate cuts by the end of the year (from the current range of 5.25% – 5.50% to 3.75% – 4.00%). Now the odds are showing we will only see one or two rate cuts by the end of the year with the odds favoring two rate cuts by the January 2025 meeting. The chart below illustrates the probabilities of where rates will be at each of the next nine Fed meetings.

The result of repricing expectations has been the recent spike in Treasury yields and bond prices moving lower, most now down year-to-date. The 2-year Treasury yield, which is sensitive to short term Fed policy and interest rates, began the year at 4.25% and has risen almost a full percent to 5.00% as of Friday, the highest since early November.

Market focus will move to earnings this week for first quarter financial results with close to 35% of S&P 500 companies reporting. So far the earnings picture has been mixed. Banks have had good results, but forecasts have been disappointing due to lower net interest income expected (the interest banks earn on its loans minus the interest it pays on client deposits at the bank). Transportation companies have reported weak results due to lower trucking volumes, although airlines are reporting better than expected results from continued strength in travel demand. Others include Netflix down after discontinuing reporting subscriber numbers, and chip maker Taiwan Semiconductor lower after cautioning on weak demand outside of AI related chips.

The result is earning growth that is trending around +0.5% after starting the quarter three weeks ago with the expectations of a 5% increase. The earnings picture for the full year has moved slightly lower. We will look for this to hold to prevent a further selloff in stocks.

Week in Review:

Stocks moved lower for the week with the S&P 500 and NASDAQ both ending with a six-day losing streak with the Dow slightly positive as value outperformed growth. The major U.S. indices finished as follows: Dow +0.01%, Russell 2000 -2.77%, S&P 500 -3.05%, and NASDAQ -5.52%. Bonds were lower again as Treasury yields rose across the curve. The 2-year Treasury yield rose 9 bps to 5.00% while the 10-year yield rose 10 bps to 4.63%. After a strong run for the dollar recently, last week saw a 0.1% increase, gold continued its record breaking run with a 1.7% increase, while Bitcoin comes under pressure with other risky investments falling 5.0%. Energy markets were very volatile, but oil finished 4.0% lower after Israel’s retaliation against Iran was less severe than feared.

Recent Economic Data

- Retail Sales: Retail sales in March rose 0.7%, nearly double the expectation of a 0.4% increase. Even better, it wasn’t due to volatile categories like gasoline or high price items like vehicles, excluding these two categories retails sales were even stronger with a 1.0% monthly increase, well above the 0.3% expected. For the month 8 of the 13 categories saw an increase in sales led by strength in online sales (+2.7%), miscellaneous stores (+2.1%), gasoline (due to higher prices, +2.1%), and general stores (+1.1%), with declines in sporting goods/hobbies, apparel, electronics, and vehicles. Over the past year retail sales are up 4.0%, just barely keeping up with inflation. The story has remained the same – sales have been strongest in service related sectors like bars/restaurants, as well as online sales and general merchandise stores (like Target, etc), and weak in goods type stores like furniture, electronics, etc.

- Housing Market Index: The housing market index, an index of homebuilder sentiment, was 51 for April which matches March’s reading for the highest level since July. Present sales index was 57, an improvement from 56 last month and the highest since last summer, expectations over the next six months fell slightly to 60 after 62 last month, while traffic of potential buyers rose slightly to 35, also the best since last summer. All levels remain relatively low, but coming off historic low levels from late 2023.

- Housing Starts & Permits: Housing starts were a major disappointment to the downside for March with a 14.7% monthly decline to a seasonally adjusted annualized pace of 1.321 million, and down about 4.3% from a year ago, for the second lowest level of housing starts since the pandemic lows of 900k. The number of permits to build new homes were not as weak, falling 4.3% to a seasonally adjusted annual rate of 1.458 million, about 1.5% above the level a year ago. In addition, the number of new homes completed fell back near the low levels from last year after a brief jump the past three months.

- Existing Home Sales: Existing home sales fell 4.3% in March to a seasonally adjusted annual rate of 4.190 million, which comes after a large jump in February. The sales pace is down 3.7% from a year ago. Sales of existing homes have remained well below the pandemic high of around the 6.6 million annual rate and about 22% below the pre-pandemic trend of about 5.4 million due to both affordability and the mortgage rate lock in phenomenon where current homeowners are hesitant to move and sell their current home that has a 3% or lower interest rate to avoid purchasing a new home with a higher mortgage rate at current rates. Inventory of existing homes grew slightly from last month and improved 11% from a year ago, but remain low from a historical perspective with just 1.11 million homes on the market. The median existing home price is up 4.8% over the past year to $393,500.

- Empire State Manufacturing Survey: The Empire State Manufacturing survey index was -14.3, an improvement from -20.9 but still deep in negative territory suggesting manufacturing activity in the New York region continues to decline. The report said new orders and shipments both declined “significantly” while delivery times shortened and inventories rose. Labor market conditions remained weak and surprisingly with weak activity, the pace of input prices increased. Optimism among respondents remained subdued.

- Philly Fed Manufacturing Survey: The Philly Fed manufacturing survey index was 15.5 for April, rising from 3.2 in March reflecting an improvement in manufacturing conditions in the Philadelphia region. The report noted general activity, new orders and shipments all rose, but saw continued weakness in employment while prices indexes remained elevated. Around 38% of firms reported increases in activity, 22% reported a decline in activity, while 40% reported no change compared to March.

- Industrial Production: US industrial production rose 0.4% in March as expected, which was due to a stronger 0.8% increase in manufacturing and offset by a 2.0% decline in mining and a 3.1% decline in utilities, which is pretty volatility and mostly correlated to weather. Capacity utilization, a measure of how much factory capacity is in use, was 78.4%, up slightly from last month and about 1% below its long run average (too high could lead to additional inflation).

- Jobless Claims: The number of jobless claims the week ended April 13 was 212,000, unchanged from the prior week. The four-week average was 214,500, also unchanged from the prior week. The number of continuing claims was 1.812 million, relatively unchanged from the prior week with the four-week average increasing slightly to 1.805 million. Very stable for jobless claims over the past several months.

Company News

- Ticketmaster Antitrust Lawsuit: The Department of Justice is reportedly planning to file a lawsuit against the ticketing and live events company Live Nation, who acquired Ticketmaster in 2010, according to the Wall Street Journal. The DoJ claims Live Nation abuses its market dominance in the ticketing of live events by leveraging its dominance in a way that undermined competition. The DoJ has been closely investigating and momentum on a lawsuit picked up after its service crashed during a presale for Taylor Swift’s Era’s Tour. The article notes Ticketmaster holds more than an 80% market share for primary ticket sales.

- Another Microsoft AI Investment: Microsoft said it will make a $1.5 billion strategic investment for a minority stake in United Arab Emirates based artificial intelligence firm G42. It says the investment will strengthen its collaboration on bringing the latest AI technologies to the UAE. G42 will run its AI applications and services on Microsoft’s Azure platform and partner to provide its AI solutions to global clients.

- Tesla’s Struggles Continue: Tesla shares continue to be under pressure, now hitting a one-year low after it said in an email sent to employees it will lay off over 10% of its global workforce to reduce costs and increase productivity. Additionally, Tesla has cut the prices of each of its models in the US by $2,000, and cut the price of its cars in other major markets including Germany and China.

- Micron Receives U.S. Grant: The Biden Administration said it has awarded memory chip maker Micron a $6.1 billion grant to produce its chips in the U.S., specifically Idaho (its current headquarters) and New York. Micron plans to build a mega fabrication plant by the end of the decade which will be home to four fabrication plants.

Other News:

- Ukraine Aid Package: The House passed a $95 billion package that provides foreign aid to Ukraine, Israel, and Taiwan despite opposition from a group of Republicans on additional aid to Ukraine. These far right Republicans have threaten to open an impeachment vote against House speaker Mike Johnson if he were to advance the package. The broader package includes a bill that would force a sale of TikTok or have the popular app face a ban in the U.S. The package now moves to the Senate where a vote is expected to take place Tuesday.

- Fed’s Beige Book: The Beige Book, a Federal Reserve report that summarizes economic conditions across each Fed district, continued to show the anecdotal evidence on the economy seen over the past year or so has been at odds with the economic data. The book noted a slight increase in overall economic activity, consumer spending that was mixed across regions but overall relatively unchanged, and several districts noting weakness in discretionary spending. There is a growing sensitivity to prices and businesses have said their ability to pass on price increases to consumers has weakened while manufacturers continue to see upside risks to inflation.

- Possible Steel Import Tariffs: President Biden is reportedly calling on U.S. Trade Representative Tai to increase tariffs on Chinese steel and aluminum imports by triple from current levels ahead of this year’s election. The current level of tariffs is 7.5% that was implemented during the Trump Administration and the proposal is to increase that to 25%. Bloomberg notes that US imports of Chinese steel are relatively low, making up just $1.7 billion of imports in 2023, but US officials want to get ahead of an expected surge in Chinese exports and support the US market.

- Fed speak:

- At a discussion with the Governor of the Bank of Canada, Fed Chairman Powell said recent data has shown “a lack of further progress so far this year” on inflation, adding that the recent data has clearly failed to give him greater confidence that inflation is on a continued trend of moving lower and it is likely to take longer to achieve that confidence.

- Other Fed speak came from NY President Williams who said policy is in a good place and doing what the Fed wants, and as a result does not see any urgency to cut rates and did not rule out the possibility of more rate hikes. Additionally, Fed Governor Bowman said policy is restrictive, but only time will tell if it is “sufficiently” restrictive after warning several days ago future rate hikes could become necessary.

WFG News

Estate Planning Seminar

May 7, 2024 @ 6:00 pm

Join us on May 7 as we welcome James Contini, Lawyer and Director of Krugliak, Wilkins, Griffiths & Dougherty Co., L.P.A. as he discusses the important need for Estate Planning and effective ways to plan for your future.

See flyer below for details.

The Week Ahead

The pace of first quarter earnings reports ramps up this week with nearly 35% of the S&P 500 providing quarterly results with a chunk of those expected to provide current quarter guidance. Some of the notable names are some of the largest companies in the world including Tesla, Meta, Alphabet, and Microsoft. Other notable company reports will come from Verizon, AT&T, Visa, PepsiCo, Texas Instruments, UPS, GM, IBM, Boeing, Chipotle, Ford, Caterpillar, Comcast, Intel, Exxon Mobil, and Chevron. The economic calendar is full of releases as well with the most notable being the first estimate of first quarter GDP on Thursday and the personal income and spending report on Friday that includes the PCE price index, the Fed’s favorite inflation read. GDP is expected to have increased 2.3% in the quarter (an annualized pace) while the PCE price index is expected to have increased 0.3% on both the headline level as well as the core index. Other data releases include new homes sales, the pending home sales index, money supply, durable goods orders, jobless claims, and the second read on April consumer sentiment. The Fed calendar is quiet as officials begin their quiet period ahead of next week’s FOMC meeting. Geopolitics will remain top of mind as well with investors monitoring the situation in the Middle East, where the conflict has so far not escalated.